Mastering the art of forex line trading is crucial in the vast and ever-changing world of Forex, as it holds the key to unlocking a realm overflowing with potential profits.

This comprehensive guide is your roadmap to understanding, implementing, and excelling in Forex line trading strategies.

If you’re an experienced trader wanting to sharpen your skills or a newbie eager to explore the currency markets, this invaluable resource is specifically designed to provide you with the knowledge and techniques necessary for success.

In the following pages, we’ll explore the intricacies of forex line trading, breaking down complex concepts into clear, actionable insights. We’ve got you covered, from demystifying trend lines to deciphering key indicators.

Here are the top 5 AI software applications for forex trading:

What is Forex Line Trading?

Before we delve into the intricacies of mastering Forex Line Trading, let’s establish a solid foundation by answering a fundamental question: What is Forex Line Trading? Forex line trading involves strategically using trend lines to analyze and predict market movements in the foreign exchange arena.

These lines, drawn on price charts, serve as visual guides that help traders identify trends, potential entry and exit points, and overall market dynamics. Now that we’ve laid the groundwork let’s explore the key components and strategies that form the core of effective Forex line trading in the upcoming sections.

Understanding the Concept of Trend Lines

Understanding the concept of trend lines is pivotal for any trader aiming to navigate the dynamic currents of the Forex market. At its core, a trend line is a graphical representation of the direction a currency pair moves.

Traders create these lines by connecting essential price points, such as highs or lows, on a price chart. The angle and placement of these lines offer valuable insights into market trends, enabling traders to discern whether an asset is undergoing an upward, downward, or sideways movement.

By grasping the nuances of trend lines, traders gain a visual roadmap that empowers them to make informed decisions, from spotting potential entry and exit points to assessing the strength and sustainability of a trend.

How Traders Utilize Trend Lines in Forex Trading

In the ever-shifting landscape of Forex trading, mastering the art of utilizing trend lines is a skill that separates successful traders from the rest. Once you’ve grasped the concept of trend lines, the next step is understanding how to wield them effectively in real-world trading scenarios. Traders employ these visual tools as passive indicators and active guides that inform their decisions at every turn.

Pinpointing Entry and Exit Points

One of the primary ways traders utilize trend lines is in pinpointing optimal entry and exit points for their trades. By strategically drawing lines that connect significant highs and lows, traders can identify potential reversal or continuation points in a trend. Breaking through a trend line might signal a trend reversal while bouncing off it could indicate a continuation. This precision in timing enhances traders’ ability to execute well-timed trades, maximizing profit potential.

Identifying Trend Reversals

Trend lines act as early warning signals for potential trend reversals, allowing traders to stay ahead of market shifts. If a currency pair has been following a distinct trend and suddenly breaks its trend line, it may signal a change in market sentiment. Savvy traders use this information to adjust their strategies accordingly, preventing potential losses and capitalizing on emerging opportunities in the market.

Evaluating Trend Strength

Beyond mere directional cues, trend lines assist traders in gauging the strength of a trend. The steepness of a trend line can indicate the momentum behind a price movement. Steeper lines suggest stronger trends, while gentler slopes may signal a more gradual ascent or descent. Understanding the strength of a trend is vital for traders seeking to align their strategies with the prevailing market conditions.

Adapting to Market Dynamics

In the dynamic world of Forex, market conditions can change rapidly. Traders who can adapt swiftly to these changes often come out on top. Trend lines give traders a dynamic tool to adjust their strategies based on evolving market dynamics. Whether tightening stop-loss orders, identifying potential breakout points, or confirming trend continuations, trend lines empower traders to navigate the market with precision and agility.

As we explore the multifaceted ways traders leverage trend lines, it becomes clear that these visual guides are more than just lines on a chart—they are invaluable tools for informed decision-making in the fast-paced world of Forex trading.

Types of Trends in Forex Line Trading

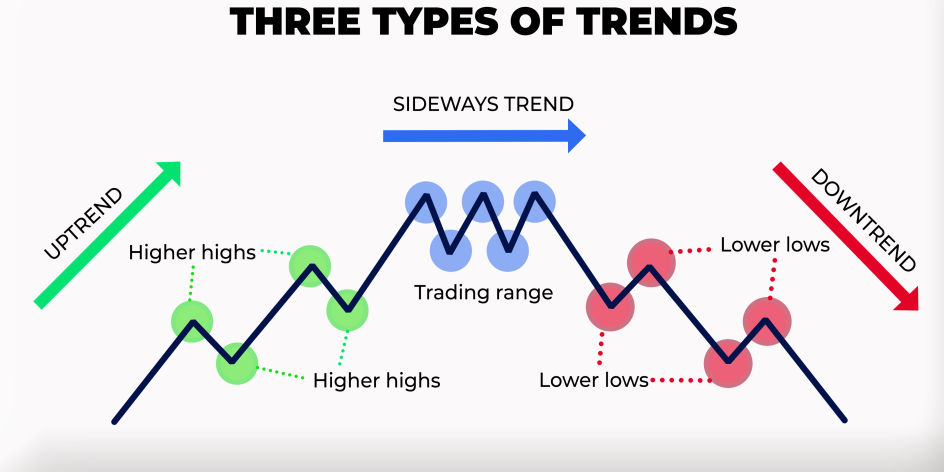

In the realm of Forex line trading, having a grasp of the diverse trends is crucial for making well-informed decisions and adjusting strategies to varying market conditions. Let’s explore the three main types of trends that traders come across:

1. Upward Trends:

An upward trend, often referred to as a bullish trend, occurs when the price of a currency pair is consistently moving higher over a period of time. Higher highs and higher lows characterize this upward movement. Traders looking to capitalize on an upward trend may seek opportunities to enter long positions, anticipating that the positive momentum will continue. Drawing a trend line along the rising lows can visually confirm the presence of an upward trend.

2. Downward Trends:

Conversely, a downward or bearish trend emerges when the price of a currency pair consistently decreases. Lower highs and lower lows mark this trend. Traders observing a downward trend may consider entering short positions, anticipating that the negative momentum will persist. Drawing a trend line along the declining highs can help confirm the presence of a downward trend.

3. Sideways Trends (or Ranges):

Sideways trends, also known as ranging markets, occur when the price of a currency pair moves within a relatively narrow range without establishing a clear upward or downward trajectory. In a sideways trend, prices fluctuate between a defined support and resistance level, creating a horizontal channel. Traders navigating a sideways market may employ different strategies, such as range trading, where they buy near support levels and sell near resistance levels. Drawing trend lines along the highs and lows of the channel can help identify potential breakout or breakdown points.

Understanding the type of trend in a given market scenario is crucial for selecting appropriate trading strategies. Traders must adapt their approach based on whether the market is trending upward, downward, or moving sideways. Furthermore, it is essential to identify transitions in trends to adapt positions and stay ahead of potential market changes. In Forex line trading, the ability to discern and act upon different types of trends is a key element in the pursuit of successful and profitable trades.

The Role of Indicators in Forex Line Trading

In Forex line trading, indicators are pivotal in enhancing traders’ analytical toolkits. These indicators are mathematical calculations based on historical price, volume, or open interest data. They provide additional insights beyond what trend lines alone can offer, helping traders make more informed decisions. Let’s explore the crucial role indicators play in Forex line trading:

1. Moving Averages:

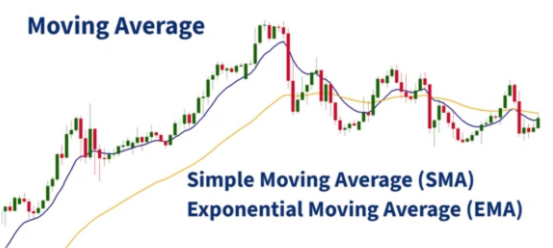

Moving averages are among the most widely used indicators in Forex trading. They smooth out price data to create a single flowing line, making it easier for traders to identify trends. The simple moving average (SMA) and the exponential moving average (EMA) represent two commonly used types. Traders often use moving averages with trend lines to confirm trends and potential reversal points.

2. Relative Strength Index (RSI):

The RSI is a momentum oscillator that measures the speed and change of price movements. It spans from 0 to 100 and is commonly employed to recognize overbought or oversold conditions within a market. Traders can integrate RSI with trend lines to confirm potential trend reversals or validate an existing trend’s strength.

3. MACD (Moving Average Convergence Divergence):

MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. Traders often use MACD to identify potential trend reversals, as crossovers between its two lines can signal changes in momentum. Combining MACD with trend lines offers a comprehensive approach to trend analysis.

4. Bollinger Bands:

Bollinger Bands consist of a middle band being an N-period simple moving average, an upper band at K times an N-period standard deviation above the middle band, and a lower band at K times an N-period standard deviation below the middle band. They help traders identify volatility and potential reversal points. Integrating Bollinger Bands with trend lines aids in confirming price movements within a given range.

5. Fibonacci Retracements:

While not a traditional indicator, Fibonacci retracements are valuable for identifying potential support and resistance levels. Traders often use them in conjunction with trend lines to determine entry and exit points, aligning their strategies with key Fibonacci levels.

The role of indicators in Forex line trading is to provide traders with additional perspectives on market conditions. By combining the insights gained from trend lines with those offered by indicators, traders can make more nuanced and informed decisions. Choosing indicators that complement the specific trading strategy and align with the trader’s overall market analysis is crucial. Effectively integrating indicators with trend lines enhances a trader’s ability to navigate the complexities of the Forex market and make strategic trading decisions.

Using Trend Lines to Make Informed Trading Decisions

In Forex trading, utilizing trend lines effectively is a cornerstone of making informed and strategic decisions. Trend lines are not just static visual guides but dynamic tools that empower traders to navigate the market with precision. Here’s how traders use trend lines to make informed trading decisions:

1. Identifying Entry and Exit Points:

Trend lines are instrumental in pinpointing optimal entry and exit points for trades. When a currency pair is in an upward trend, traders may look for opportunities to enter a long position when the price touches or bounces off the upward trend line. On the flip side, possible short entry points could be pinpointed during a downward trend as the price nears or breaches the trend line. By aligning entry and exit points with the course of the trend lines, traders optimize the potential for lucrative trades.

2. Confirming Trend Strength:

The slope and steepness of trend lines offer insights into the strength of a trend. Steeper trend lines typically indicate a stronger and more sustainable trend, while gentler slopes may suggest a slower and potentially less stable movement. Traders can evaluate the robustness of a trend by observing how the price engages with the trend line. Consistent bounces or breaks through the trend line can provide valuable information about the robustness of the current market trend.

3. Setting Stop-Loss and Take-Profit Levels:

Trend lines are integral in risk management strategies. Traders often use trend lines to set stop-loss and take-profit levels. Placing a stop-loss just below an upward trend line or just above a downward trend line can help mitigate potential losses in an unexpected market reversal. Similarly, take-profit levels may be strategically placed near a trend line to capitalize on expected price movements within the trend.

4. Recognizing Trend Reversals:

Trend lines act as early warning signals for potential trend reversals. When a price breaks through a trend line, it may indicate a shift in market sentiment. Traders utilize this information to adjust their strategies, which may include closing current positions, reversing trades, or waiting for additional confirmation of a new trend direction.

5. Assessing Trend Continuations:

Traders also use trend lines to assess the likelihood of trend continuation. If the price consistently bounces off an upward trend line or breaks through a downward trend line but quickly returns, it suggests a potential continuation of the existing trend. Recognizing these patterns allows traders to stay ahead of market movements and adjust their positions accordingly.

In conclusion, using trend lines to make informed trading decisions involves technical analysis, risk management, and adaptability. Integrating trend lines into their comprehensive trading strategy provides traders with a visual framework that directs their decisions, improves risk-reward ratios, and ultimately contributes to a more successful and sustainable approach in the dynamic realm of Forex trading.

How to use trend lines in forex trading?

Importance of Drawing Accurate and Effective Trend Lines

Drawing accurate and effective trend lines is a fundamental skill for any trader venturing into the dynamic world of Forex. These visual guides are the backbone of technical analysis, providing critical insights into market trends, potential reversals, and optimal entry and exit points. Here’s a breakdown of why the precision in drawing trend lines is of paramount importance:

1. Visual Representation of Trends: Accurate trend lines clearly represent the prevailing market trend. Whether it’s an upward trajectory, a downward descent, or a sideways movement, trend lines help traders quickly identify and understand the directional bias of a currency pair. This visual clarity forms the basis for making informed trading decisions.

2. Timing Entry and Exit Points: The precision in drawing trend lines directly impacts a trader’s ability to time entry and exit points effectively. By accurately connecting significant highs and lows, traders can identify strategic points at which the price is likely to bounce off or break through the trend line. This timing is crucial for maximizing profits and minimizing losses.

3. Confirmation of Trend Strength: The slope and steepness of trend lines provide insights into the strength of a trend. Accurate trend lines allow traders to gauge the momentum behind a price movement. Steeper lines may indicate a stronger and more sustainable trend, while gentler slopes suggest a slower ascent or descent. Confirming trend strength helps traders align their strategies with the prevailing market conditions.

4. Identifying Trend Reversals: Accurate trend lines act as early indicators of potential trend reversals. When a price breaks through a trend line, it may signal a shift in market sentiment. Precise identification of trend reversals allows traders to adapt their strategies promptly, preventing potential losses and capitalizing on emerging opportunities in the market.

5. Risk Management and Stop-Loss Placement: Effective risk management is a cornerstone of successful trading. Accurate trend lines assist traders in setting strategic stop-loss levels. Placing stop-loss orders just below an upward trend line or just above a downward trend line helps mitigate potential losses in case of unexpected market movements. This risk management approach is essential for preserving capital.

6. Building Confidence in Trading Decisions: Drawing trend lines accurately enhances traders’ confidence in their decisions. When armed with precise trend analysis, traders can approach the market with a clear and informed mindset. Confidence is a key factor in executing trading strategies with conviction and resilience, especially in market volatility.

Identifying Different Types of Trends in Forex

In forex trading, recognizing and understanding different types of trends is fundamental to making informed decisions and executing effective trading strategies. Here’s a breakdown of the various trend types commonly observed in the Forex market:

1. Upward Trends (Bullish): In an upward trend, also known as a bullish trend, the price of a currency pair consistently moves higher over a certain period. Successive higher highs and higher lows characterize this movement. Traders identify upward trends by drawing trend lines connecting these ascending lows. Recognizing an upward trend is crucial for traders looking to capitalize on potential buying opportunities.

2. Downward Trends (Bearish): Conversely, a downward trend, or bearish trend, occurs when the price of a currency pair consistently decreases. Successive lower highs and lower lows mark this trend. Traders identify downward trends by drawing trend lines connecting these descending highs. Recognizing a downward trend is essential for traders seeking opportunities to profit from potential price declines through short selling or other bearish strategies.

3. Sideways Trends (Ranging): Sideways trends, also known as ranging markets, happen when the price of a currency pair moves within a relatively narrow range without establishing a clear upward or downward trajectory. In a sideways trend, prices fluctuate between a defined support and resistance level. Traders navigating a sideways market may employ range-bound strategies, buying near support levels and selling near resistance levels.

Understanding these trend types goes beyond merely identifying directional movements; it also provides valuable insights into market dynamics and potential opportunities. Traders often use technical analysis tools, including trend lines, to confirm and validate the presence of these trends.

4. Trend Reversals: Identifying trend reversals is crucial to trend analysis. A trend reversal occurs when an established upward or downward trend changes direction. Traders keen on trend reversals look for signs such as breaking trend lines, shifts in momentum indicators, or forming reversal chart patterns. Recognizing trend reversals allows traders to adjust their strategies and capitalize on emerging market shifts.

5. Trend Continuations: While identifying reversals is important, so is recognizing trend continuations. A trend continuation suggests that the prevailing trend is likely to persist. Traders assess the strength of a trend by observing how the price interacts with trend lines and key support or resistance levels. Recognizing trend continuations enables traders to stay aligned with the dominant market direction.

Utilizing Trend Lines to Establish Support and Resistance Levels

In the dynamic world of Forex trading, trend lines serve as indispensable tools for establishing key support and resistance levels. These levels play a crucial role in shaping trading strategies, aiding traders in making informed decisions, and optimizing risk management. Let’s explore how trend lines are effectively utilized for this purpose:

1. Defining Support Levels: Support levels are price levels at which a currency pair tends to find buying interest, preventing the price from falling further. When using trend lines to establish support levels, traders draw a line connecting the lows during an upward trend. This trend line acts as a visual guide, indicating the lower boundary of the price’s potential downward movement. Bounces off this trend line confirm the presence of support, providing traders with strategic entry points.

2. Identifying Resistance Levels: Resistance levels represent price levels at which a currency pair encounters selling interest, preventing the price from rising further. To identify resistance levels using trend lines, traders draw lines connecting the highs during a downward trend. This trend line acts as a visual guide, outlining the upper boundary of the price’s potential upward movement. Touches or breaks through this trend line signal the existence of resistance, helping traders strategically plan exit points.

3. Role in Risk Management: Establishing support and resistance levels using trend lines is integral to effective risk management. Traders often place stop-loss orders just below the identified support level in an upward trend and just above the resistance level in a downward trend. This approach helps mitigate potential losses by exiting positions if the price breaks through these critical levels, safeguarding capital and contributing to disciplined trading.

4. Confirmation of Price Movements: Trend lines are confirmation tools for price movements. When the price approaches a trend line, traders closely monitor its behavior. A bounce off the trend line strengthens the validity of the support or resistance level, confirming the ongoing trend. Conversely, a break through the trend line signals a potential shift in market sentiment, prompting traders to reassess their positions and strategies.

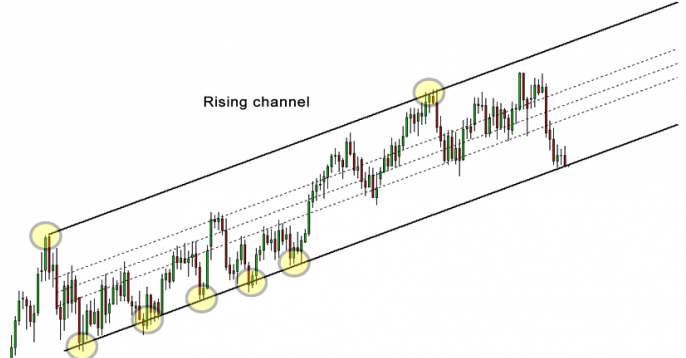

5. Drawing Channels for Range-Bound Trading: Beyond individual support and resistance levels, trend lines can draw channels defining a range-bound market. Traders connect the highs and lows of price movements to create parallel trend lines, establishing the upper and lower boundaries of the trading range. In a ranging market, traders may employ strategies like buying near support and selling near resistance until a clear trend emerges.

Incorporating Trend Lines in Trading Strategies

In the dynamic world of forex trading, incorporating trend lines into strategies is a fundamental approach savvy traders employ to gain a competitive edge. These visual tools offer valuable insights into market trends, and their strategic integration into trading strategies can enhance decision-making and increase the probability of successful trades. Here’s how traders effectively incorporate trend lines into their trading strategies:

1. Confirming Trend Direction: One of the primary uses of trend lines is to confirm the direction of the prevailing trend. Traders draw trend lines along the highs or lows of price movements, helping them identify whether the market is upward, downward, or sideways. This confirmation is essential for aligning trading strategies with the prevailing market conditions.

2. Establishing Entry and Exit Points: Accurate trend lines assist traders in establishing optimal entry and exit points. In an upward trend, traders may enter long positions when the price bounces off the upward trend line, aiming to capture potential upward movements. Conversely, in a downward trend, short positions may be considered when the price touches or breaks below the downward trend line. Establishing these points strategically contributes to maximizing profits and minimizing losses.

3. Trend Reversals and Continuations: Trend lines are pivotal in identifying potential trend reversals and continuations. When a price breaks through a trend line, it may signal a shift in market sentiment. Traders who are keen on trend reversals adjust their strategies accordingly. Conversely, persistent rebounds from a trend line could suggest the continuation of a trend. Recognizing these patterns allows traders to adapt their positions in alignment with the evolving market dynamics.

4. Dynamic Stop-Loss Placement: Integrating trend lines into risk management strategies involves placing dynamic stop-loss orders. Traders often position stop-loss levels just below an upward trend line or just above a downward trend line. This approach enables them to adapt to changing market conditions, limiting potential losses while allowing trades room to breathe within the established trend boundaries.

5. Trend Channels for Range-Bound Trading: Traders leverage trend lines to draw channels that define a range-bound market. Parallel trend lines create upper and lower boundaries by connecting the highs and lows. Traders can implement range-bound strategies, buying near support and selling near resistance until a clear trend emerges. Trend channels offer a structured framework for executing trades within established price ranges.

6. Incorporating Trend Lines with Candlestick Patterns: Combining trend lines with candlestick patterns enhances the precision of trading strategies. Traders may look for candlestick formations around trend lines, such as reversal patterns or confirmatory signals, to strengthen the reliability of their trading decisions. This integration of trend lines with candlestick analysis provides a more comprehensive approach to technical analysis.

Combining Trend Lines with Other Technical Indicators

Trend lines are powerful, but combining them with other technical indicators elevates their effectiveness. This final section will explore the synergy between trend lines and indicators such as Moving Averages, RSI, and Bollinger Bands. Understanding how these tools complement each other empowers traders with a comprehensive analytical approach, offering a more nuanced understanding of market dynamics and enhancing the accuracy of trading decisions.

As we navigate through these sections, the goal is not just to comprehend the importance of drawing accurate trend lines but to equip traders with practical knowledge and strategies that can be immediately applied in the dynamic Forex market. By mastering the art of trend line analysis, traders position themselves for success in a realm where precision and adaptability are key.

Benefits and Strategies of Forex Line Trading

Forex line trading, centered around the strategic use of trend lines, offers a range of benefits and effective strategies for traders seeking to navigate the dynamic currency markets. Let’s explore the advantages and key strategies associated with this approach:

Benefits of Forex Line Trading:

Visual Clarity and Simplified Analysis:

- Forex line trading provides visual clarity by representing market trends with trend lines. This simplicity aids traders in quickly understanding the prevailing market direction without getting bogged down by complex indicators or charts.

Identification of Trends and Trend Reversals:

- Trend lines help traders identify trends, whether upward, downward, or sideways. Additionally, trend lines act as early warning signals for potential trend reversals, allowing traders to adapt their strategies promptly.

Precision in Entry and Exit Points:

- Accurate trend lines enable traders to establish precise entry and exit points. Whether trading breakouts or bounces, aligning positions with trend lines enhances the precision of trade execution.

Risk Management and Stop-Loss Placement:

- Forex line trading integrates seamlessly with risk management strategies. Traders can position stop-loss orders strategically based on trend lines, helping manage and limit potential losses while allowing for dynamic adjustments.

Adaptability to Market Dynamics:

- The simplicity of trend lines facilitates quick adaptation to changing market conditions. Traders can adjust their strategies based on how the price interacts with trend lines, allowing for flexibility in response to evolving trends.

Strategies of Forex Line Trading:

Trend Confirmation and Validation:

- Use trend lines to confirm and validate the direction of trends. Confirming an upward trend involves connecting successive higher lows, while a downward trend connects lower highs. This strategy ensures alignment with the prevailing market sentiment.

Bounce and Breakout Trading:

- Employ trend lines for bounce and breakout trading strategies. When the price approaches an upward trend line, consider entering a long position if it bounces off. Conversely, short positions might be regarded as in a downward trend when the price breaks below the trend line.

Dynamic Support and Resistance:

- Establish support and resistance levels using trend lines. These levels act as dynamic zones where prices may bounce off or breakthrough. Combining horizontal support and resistance levels with trend lines strengthens these key zones.

Channels and Range Trading:

- Draw trend lines to create channels that define a range-bound market. Range trading strategies involve buying near support and selling near resistance until a clear trend emerges. Trend lines provide a structured framework for executing trades within established price ranges.

Combining Trend Lines with Indicators:

- Enhance trend line analysis by combining them with technical indicators such as moving averages, RSI, or Bollinger Bands. This integration provides additional confirmation and refines entry and exit points.

Multiple Timeframe Analysis:

- Apply trend lines across multiple timeframes for a comprehensive analysis. This strategy helps traders identify trends on higher timeframes for overall market direction and use lower timeframes for precise entry and exit timing.

Forex line trading, anchored by trend lines’ strategic use, offers traders simplicity, clarity, and adaptability. The benefits and strategies outlined above provide a foundation for developing a robust approach to navigating the complexities of the currency markets. By leveraging the advantages and implementing effective strategies, traders can enhance their ability to make informed and strategic decisions in the fast-paced world of Forex trading.

Chart Analysis in Forex Line Trading

Forex line trading involves analyzing charts to identify various types of trends and make informed trading decisions. Understanding these trends and employing chart analysis with trend lines is crucial for successful trading. Let’s explore the types of trends and key aspects of chart analysis in the context of Forex line trading:

Trend Confirmation:

- Forex line traders begin by confirming the direction of the trend. By drawing trend lines along the highs and lows, traders visually confirm whether the market is in an upward, downward, or sideways trend. This confirmation is a foundational step for further analysis.

Entry and Exit Points:

- Accurate trend lines help traders establish optimal entry and exit points. In an upward trend, entering near the trend line during a bounce may be considered, while in a downward trend, short positions near the trend line could be explored. These entry and exit points are aligned with the trend direction.

Support and Resistance Identification:

- Trend lines play a vital role in identifying support and resistance levels. Support levels are established by connecting successive higher lows, while resistance levels are formed by connecting lower highs. These levels act as key zones where the price may bounce off or break through.

Pattern Recognition:

- Forex line traders use trend lines to recognize chart patterns that provide additional insights. Patterns such as triangles, flags, or channels formed by trend lines can indicate potential breakouts or breakdowns, offering traders opportunities to enter or exit positions.

Multiple Timeframe Analysis:

- Traders often employ multiple timeframe analyses to gain a comprehensive market view. Trend lines drawn on higher timeframes provide insights into the overall trend direction, while lower timeframes assist in precise entry and exit timing. This holistic approach enhances decision-making.

Dynamic Stop-Loss Placement:

- Integrating trend lines into risk management strategies involves placing dynamic stop-loss orders. Traders position stop-loss levels just below an upward trend line or just above a downward trend line, adapting to changing market conditions and mitigating potential losses.

Understanding the types of trends and effectively conducting chart analysis with trend lines allows Forex traders to navigate the market with precision. This approach facilitates strategic decision-making, risk management, and the identification of potential trading opportunities. As trends progress, traders can adjust their strategies by employing trend lines to remain proactive in the ever-changing landscape of Forex trading.

Advanced Techniques and Tips for Mastering Forex Line Trading

Becoming proficient in Forex line trading requires a thorough comprehension of advanced techniques and insights that extend beyond the fundamentals. Here are some advanced strategies and insights to assist traders in refining their approach to Forex line trading:

Advanced Techniques:

Fibonacci Extensions with Trend Lines:

- Combine trend lines with Fibonacci extensions to identify potential price targets. After drawing trend lines to establish the trend, apply Fibonacci extensions to project future price levels. This technique helps traders set more precise profit targets in the direction of the trend.

Volume Analysis with Trend Lines:

- Incorporate volume analysis into trend line trading. Look for volume spikes near trend lines, as they can provide additional confirmation of the validity of the trend. Volume analysis enhances the understanding of market dynamics and the strength of price movements.

Pitchfork Analysis:

- Explore pitchfork analysis, which involves drawing trend lines to create channels or forks based on significant price highs and lows. Pitchforks help traders identify potential reversal or continuation zones, providing a more advanced perspective on market trends.

Ichimoku Clouds:

- Integrate the Ichimoku Cloud indicator with trend lines for a comprehensive analysis. The Ichimoku Cloud incorporates multiple lines, including the Kijun Sen and Tenkan Sen, which can complement trend lines and offer additional signals for trend direction and potential reversal points.

Pattern Recognition Beyond Trend Lines:

- Master advanced chart patterns beyond basic trend lines, such as head and shoulders, double tops, and triangles. Combining pattern recognition with trend lines allows for a more sophisticated approach to identifying potential trend reversals or continuations.

Tips for Advanced Forex Line Trading:

Dynamic Trend Lines:

- Adjust trend lines dynamically by considering more recent price action. This involves redrawing trend lines based on the latest market developments to ensure they accurately reflect the current trend direction and strength.

Watch for Trend Line Breaks and Retests:

- Pay close attention to trend line breaks and subsequent retests. A break followed by a retest can offer valuable confirmation of a new trend direction. Traders may consider entering positions after a successful retest.

Utilize Confluence Zones:

- Identify confluence zones where multiple technical factors align. This includes the intersection of trend lines with horizontal support/resistance levels, Fibonacci retracement levels, or key moving averages. Confluence zones enhance the significance of these levels.

Consider Geometric Patterns:

- Explore geometric patterns formed by trend lines, such as channels or triangles. These patterns can provide insights into potential breakout or breakdown scenarios, offering advanced opportunities for entering or exiting trades.

Backtesting and Analysis:

- Conduct thorough backtesting and analysis of historical price action with trend lines. Evaluate how different market conditions and trend line configurations have influenced price movements. This data-driven approach can enhance decision-making in live trading.

Continuous Learning and Adaptation:

- Stay informed about new developments in technical analysis and Forex markets. Continuous learning and adaptation to changing market dynamics are crucial for mastering Forex line trading. Attend webinars, read research papers, and engage with the trading community to stay ahead.

By incorporating these advanced techniques and tips into their Forex line trading strategy, traders can refine their skills and enhance their ability to make well-informed decisions in the dynamic and competitive world of Forex markets.

Achieving mastery in Forex Line Trading through AI Integration

Mastering Forex Line Trading using AI involves harnessing the power of artificial intelligence to enhance decision-making and strategy execution in the dynamic foreign exchange market. By leveraging AI algorithms and machine learning, traders can analyze vast amounts of data, identify intricate patterns, and gain valuable insights that may not be readily apparent through traditional methods.

The application of AI Forex trading software allows for more accurate trend predictions, risk management, and timely execution of trades. Traders can benefit from automated tools that continuously adapt to market conditions, providing a competitive edge and efficiency in navigating the complexities of currency markets. Integrating AI into Forex Line Trading empowers traders to stay informed, make data-driven decisions, and optimize their trading approaches for greater success in the ever-evolving landscape of financial markets.