Hey there, crypto enthusiasts! Did you know that over 80% of crypto trades are now executed by bots?

Yeah, I couldn’t believe it either when I first heard it. But let me tell you, it’s a game-changer, especially for us beginners in the crypto world.

In this article, I’m going to share with you 21 best AI crypto trading bots that are perfect for beginners like us in 2025. We’ll dive into what these bots are, how to choose the right one, and even how to get started. So, buckle up and let’s explore the exciting world of AI crypto trading bots!

21 Best AI Crypto Trading Bots for Beginners

In this comprehensive review, I present the best 21 AI crypto trading bots for beginners in 2025. Each bot has been meticulously evaluated based on four critical factors: key features, pricing structures, advantages, and potential drawbacks.

This analysis aims to provide novice traders with a clear understanding of each tool’s capabilities and limitations. The selection ranges from user-friendly platforms with intuitive interfaces to more sophisticated systems offering advanced algorithmic strategies.

By examining these determining factors, traders can make informed decisions that align with their individual needs, risk tolerance, and budgetary constraints. This curated list serves as a valuable resource for those looking to leverage AI technology in navigating the dynamic cryptocurrency markets efficiently and effectively.

1. Cryptohopper: User-Friendly and Feature-Rich

Cryptohopper was my first love in the bot world. It’s like having a personal crypto assistant that never sleeps!

Key features:

- Automated trading strategies

- Backtesting

- Social trading

Pricing: They offer a free 7-day trial, with plans starting at $19/month.

Pros:

- Great for both beginners and advanced traders

- Awesome community of traders

- Supports a wide range of exchanges

Cons:

- The learning curve can be steep

- Some users report occasional lag in executions

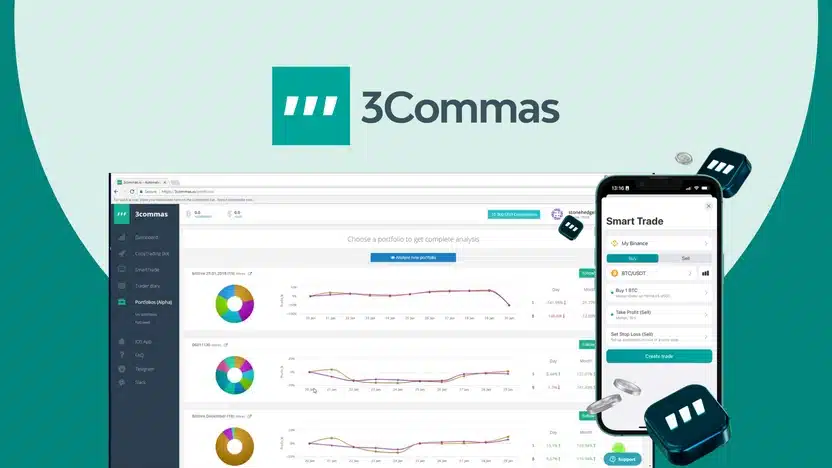

2. 3Commas: The All-in-One Trading Solution

I remember when I first stumbled upon 3Commas – it was like finding a treasure chest in the crypto ocean! This bot is seriously user-friendly, which is a godsend for us newbies.

Key features:

- Smart Trading terminal

- DCA (Dollar-Cost Averaging) bots

- Grid bots

- Options bots

Pricing: They’ve got a free plan, but the real magic happens in their paid plans, starting at $29/month.

Pros:

- Super intuitive interface

- Tons of pre-made bot strategies

- Paper trading for practice

Cons:

- Can be a bit overwhelming with all the features

- Some advanced features only available in pricier plans

3. Pionex: Built-in Bots for Seamless Trading

Pionex caught my eye because it’s actually an exchange with built-in bots. Talk about convenience!

Key features:

- Grid trading bot

- Leveraged ETF bot

- Arbitrage bot

Pricing: The bots are free to use, but you pay trading fees.

Pros:

- No additional bot fees

- Easy to set up and use

- Low trading fees

Cons:

- Limited to Pionex exchange only

- Fewer advanced features compared to standalone bots

4. Trality: Code-Free Bot Creation

Trality is like the cool kid on the block for those who want to dip their toes into algo trading.

Key features:

- Code editor for Python

- Rule-based bot creation

- Backtesting and paper trading

Pricing: Free plan available, paid plans start at €9.99/month.

Pros:

- Great for learning algorithmic trading

- No coding experience necessary for rule-based bots

- Robust backtesting capabilities

Cons:

- Limited number of bots in lower-tier plans

- Can be complex for absolute beginners

5. Bitsgap: Comprehensive Portfolio Management

Bitsgap was a lifesaver when I wanted to manage multiple exchange accounts. It’s like having a Swiss Army knife for crypto trading!

Key features:

- Multi-exchange trading

- Portfolio management

- Demo mode for practice

Pricing: 14-day free trial, then plans start at $19/month.

Pros:

- Comprehensive trading tools in one place

- User-friendly interface

- Excellent customer support

Cons:

- Some features can be glitchy at times

- Higher-tier plans can be pricey

6. Coinrule: IF-THEN Strategies Made Simple

Coinrule feels like the “if this, then that” of crypto trading. It’s perfect for those who like to set their own rules.

Key features:

- Rule-based trading strategies

- Template strategies for beginners

- Demo mode for testing

Pricing: Free plan available, paid plans start at $29.99/month.

Pros:

- No coding required

- Intuitive rule-creation interface

- Good balance of simplicity and power

Cons:

- Limited number of rules in lower-tier plans

- Can take time to master rule creation

7. HaasOnline: Advanced Customization for Tech-Savvy Traders

Haasonline is like the Swiss watch of trading bots – precise, reliable, but definitely an investment.

Key features:

- Advanced backtesting

- Customizable trading bots

- Supports crypto and forex

Pricing: Starts at 0.073 BTC per year (yep, priced in Bitcoin!)

Pros:

- Extremely powerful and customizable

- Great for advanced traders

- Solid security features

Cons:

- Steep learning curve

- Expensive compared to other options

8. Shrimpy: Social Trading and Portfolio Rebalancing

Shrimpy swam into my life when I was looking for a way to automate my portfolio rebalancing. It’s a neat little tool!

Key features:

- Automated portfolio rebalancing

- Social trading

- API for developers

Pricing: Free plan available, paid plans start at $15/month.

Pros:

- Simple to use for portfolio management

- Good for long-term investors

- Decent free plan

Cons:

- Limited trading features compared to others

- Can be slow during high volatility periods

9. TradeSanta: Cloud-Based Automation

TradeSanta feels like having a jolly crypto elf working for you 24/7. It’s straightforward and gets the job done.

Key features:

- Long and short bots

- DCA and Grid strategies

- Mobile app

Pricing: Starts at $14/month for the Basic plan.

Pros:

- Easy to set up and use

- Supports major exchanges

- Responsive customer support

Cons:

- Limited customization options

- Some users report occasional trade execution delays

10. Botsfolio: Beginner-Friendly with Pre-built Strategies

Last but not least, Botsfolio. This one’s like having a robo-advisor for your crypto portfolio.

Key features:

- AI-powered portfolio management

- Risk-adjusted strategies

- No need for manual trading

Pricing: Starts at $14.99/month after a 7-day free trial.

Pros:

- Hands-off approach to crypto investing

- Focuses on risk management

- Good for long-term investors

Cons:

- Limited control over trading strategies

- Relatively new compared to other options

11. Gunbot: One-Time Payment Option

Gunbot is like buying a car instead of leasing it. Pay once, use forever. Sounds great, right? Well, mostly.

Key Features:

- One-time license fee

- Supports multiple exchanges

- Customizable strategies

Pricing and Plans:

- Starter: $199 (one-time)

- Standard: $499 (one-time)

- Pro: $999 (one-time)

Pros:

- No recurring fees

- Highly customizable

- Active community for support

Cons:

- Steeper initial cost

- Can be complex for beginners

12. Kryll: Drag-and-Drop Strategy Builder

Kryll is like playing with Lego blocks, but instead of a spaceship, you’re building trading strategies. It’s fun and surprisingly powerful.

Key Features:

- Visual strategy builder

- Marketplace for strategies

- Backtesting tools

Pricing and Plans:

- Holdraker: €19/month

- Moonraker: €49/month

- Goldfinger: €99/month

Pros:

- Intuitive drag-and-drop interface

- Good balance of simplicity and power

- Active community

Cons:

- Limited advanced features

- Can get expensive for high-volume trading

13. Bybit: Exchange-Integrated Bot Trading

Bybit’s bot is like having a built-in co-pilot on your favorite exchange. It’s convenient, but it comes with its own set of quirks.

Key Features:

- Grid and DCA trading bots

- Integrated with Bybit exchange

- Futures and spot trading

Pricing and Plans:

- Free to use (makes money on trading fees)

Pros:

- No additional cost to use bots

- Seamless integration with Bybit

- Good for both spot and futures trading

Cons:

- Limited to Bybit exchange

- Fewer features compared to standalone bots

14. Cryptorobotics: Multi-Exchange Support

Cryptorobotics is like a polyglot at a United Nations meeting. It speaks the language of many exchanges, which can be pretty handy.

Key Features:

- Supports multiple exchanges

- Manual and automated trading

- Technical analysis tools

Pricing and Plans:

- Basic: $19.99/month

- Advanced: $39.99/month

- Pro: $59.99/month

Pros:

- Wide range of supported exchanges

- Good balance of manual and automated features

- Solid charting tools

Cons:

- Interface can be overwhelming

- Some users report occasional stability issues

15. KuCoin: Native Exchange Bot

KuCoin’s bot is like the house band at your local pub. It might not be the fanciest, but it gets the job done and you don’t have to go far to use it.

Key Features:

- Grid and DCA trading bots

- Integrated with KuCoin exchange

- Futures grid bot

Pricing and Plans:

- Free to use (makes money on trading fees)

Pros:

- No additional cost to use bots

- Easy to set up and use

- Good for KuCoin users

Cons:

- Limited to KuCoin exchange

- Fewer features than standalone bots

16. Learn 2 Trade: Educational Focus with Signal Service

Learn 2 Trade is like having a trading tutor and a bot rolled into one. It’s great if you want to learn while you earn.

Key Features:

- Trading signals

- Educational resources

- Automated trading features

Pricing and Plans:

- Free plan available

- Premium: $15/week

Pros:

- Strong focus on education

- Good for beginners

- Affordable pricing

Cons:

- Limited advanced features

- Some users report inconsistent signal quality

17. Smart Trade Bot: Automated Grid Trading

Smart Trade Bot is like a fisherman casting a wide net. It uses grid trading to catch profits in ranging markets.

Key Features:

- Automated grid trading

- Multi-pair trading

- Take profit and stop loss features

Pricing and Plans:

- Basic: $19.99/month

- Pro: $49.99/month

- VIP: $99.99/month

Pros:

- Effective in sideways markets

- Easy to set up grid strategies

- Good risk management features

Cons:

- Not ideal for trending markets

- Limited features beyond grid trading

18. Binance: Powerful Exchange-Based Bot

Binance’s bot is like having a Swiss Army knife in the world’s largest crypto playground. It’s versatile and right where the action is.

Key Features:

- Multiple bot types (Grid, Infinity Grid, Spot-Futures Arbitrage)

- Integrated with Binance exchange

- Supports a wide range of trading pairs

Pricing and Plans:

- Free to use (makes money on trading fees)

Pros:

- No additional cost to use bots

- Wide range of bot types

- Seamless integration with Binance

Cons:

- Limited to Binance exchange

- Can be complex for absolute beginners

19. Coinigy: Advanced Charting and Multiple Exchange Management

Coinigy is like having a command center for your crypto empire. It’s got charts, it’s got bots, it’s got everything but the kitchen sink.

Key Features:

- Advanced charting tools

- Supports multiple exchanges

- Portfolio management

Pricing and Plans:

- Pro: $18.66/month (billed annually)

- Business: Custom pricing

Pros:

- Powerful charting capabilities

- Good for managing multiple exchanges

- Solid API for developers

Cons:

- Can be overwhelming for beginners

- More focused on charting than bot trading

20. Hummingbot: Open-Source Option for Tech-Savvy Traders

Hummingbot is like a DIY kit for trading bots. If you like to get your hands dirty with code, this one’s for you.

Key Features:

- Open-source platform

- Market making and arbitrage strategies

- Supports multiple exchanges

Pricing and Plans:

- Free and open-source

Pros:

- Completely free to use

- Highly customizable

- Active developer community

Cons:

- Requires technical knowledge

- Limited support compared to paid options

21. OKX: AI-Powered Trading on a Major Exchange

OKX’s AI trading bot is like having a crystal ball that’s plugged into one of the biggest crypto exchanges out there.

Key Features:

- AI-powered trading strategies

- Integrated with OKX exchange

- Supports spot and futures trading

Pricing and Plans:

- Free to use (makes money on trading fees)

Pros:

- No additional cost to use bots

- Leverages AI for strategy optimization

- Good for both spot and futures trading

Cons:

- Limited to OKX exchange

- AI strategies may be a black box for some users

Whew! That’s a lot of bots, right? Each one has its own strengths and quirks. Remember, the key is to find the one that fits your trading style and goals. Don’t be afraid to try out a few (most offer free trials) before settling on your digital trading buddy.

And here’s a final piece of advice from someone who’s been through the crypto rollercoaster: no matter how smart these bots are, always keep an eye on them. They’re tools, not magic wands. Use them wisely, and may your trades be ever in your favor!

Comparison of Best AI Crypto Trading Bots

Alright, folks, let’s dive into the nitty-gritty of these AI crypto trading bots. I’ve spent more nights than I care to admit comparing these digital money-makers, and I’m gonna break it down for you. Grab a cup of coffee (or something stronger, I won’t judge), and let’s get into it!

Let’s break this down into a few key areas: performance, cost, user satisfaction, and those special little quirks that make each bot unique. Grab a coffee (or something stronger, I won’t judge), and let’s get into it.

Performance

Now, performance is a tricky beast. It’s like trying to nail jello to a wall – slippery and often messy. But from my experience and the general consensus in the crypto community, here’s the lowdown:

- 3Commas and Cryptohopper consistently rank high in performance. They’re like the star athletes of the bot world. I’ve seen these bad boys pull off some impressive moves in both bull and bear markets.

- Bitsgap and TradeSanta are solid middle-of-the-pack performers. They might not win you the crypto Olympics, but they’ll keep you in the race.

- Exchange-native bots like Binance and KuCoin tend to perform well within their ecosystems. It’s like they’ve got home field advantage.

- Pionex and Trality have been gaining ground lately. They’re like the underdogs that suddenly start winning races.

Remember, past performance doesn’t guarantee future results. I learned that the hard way when I thought I’d cracked the code with a killer strategy on 3Commas, only to watch it flounder in a sudden market shift. Oops.

Cost

Ah, the age-old question: How much dough do I need to shell out for these digital trading buddies? Here’s the breakdown:

- Free options: Pionex, Binance, KuCoin, and OKX offer free bots integrated into their exchanges. But remember, there’s no such thing as a free lunch – they make money on trading fees.

- Budget-friendly: Cryptohopper and TradeSanta start at around $19/month. Not bad for dipping your toes in the bot waters.

- Mid-range: 3Commas, Bitsgap, and Kryll fall in the $30-$50/month range for their basic plans. It’s like the Goldilocks zone of bot pricing.

- Premium: HaasOnline is the Rolls-Royce of bots, with plans starting at 0.073 BTC per year. That’s a chunk of change, but hey, quality costs.

- One-time payment: Gunbot offers a lifetime license for a one-time fee. It’s like buying a car instead of leasing it.

User Satisfaction

This is where things get interesting. It’s like reading reviews for a restaurant – everyone’s got an opinion, and they’re not afraid to share it.

- 3Commas and Cryptohopper generally have high user satisfaction. They’re like the popular kids in high school – everyone seems to like them.

- Trality and Kryll users rave about their intuitive interfaces. It’s like they’ve found the holy grail of user-friendliness.

- HaasOnline users love the customization but admit it’s got a learning curve steeper than Mount Everest.

- Pionex gets props for its simplicity, but some users wish it had more advanced features.

- Binance and KuCoin bots are popular among users already on these exchanges. It’s convenient, but some folks feel limited by the lack of cross-exchange options.

Unique Attributes

Here’s where each bot gets to shine like a diamond in the rough:

- 3Commas: The Swiss Army knife of bots. It’s got everything but the kitchen sink.

- Cryptohopper: A marketplace for trading strategies. It’s like a farmers market for bot algorithms.

- Trality: Code-free bot creation. It’s for when you want to feel like a coding wizard without learning to code.

- Bitsgap: Excellent portfolio management tools. It’s like having a personal assistant for your crypto holdings.

- Shrimpy: Social trading features. You can copy the pros, or at least people who claim to be pros.

- Gunbot: One-time payment model. No subscription fatigue here!

- Hummingbot: Open-source for the tech-savvy traders. It’s like a DIY kit for bot enthusiasts.

- OKX: AI-powered strategies. It’s like having a crystal ball, but don’t expect it to predict the next meme coin explosion.

Now, here’s the kicker – the best bot for you depends on your trading style, experience level, and goals. It’s like choosing a dance partner; you need one that matches your rhythm.

I remember when I first started, I went for the bot with the most features. Big mistake. I spent more time trying to figure out the bot than actually trading. Now, I look for a balance of features, ease of use, and cost.

One final piece of advice: don’t put all your eggs in one bot basket. I like to use a combination of bots for different strategies. It’s like diversifying your portfolio, but with digital trading assistants.

Remember, these bots are tools, not magic wands. They can’t predict the future (if they could, I’d be writing this from my private island), but they can help you navigate the choppy waters of the crypto market.

So there you have it, folks. A down-and-dirty comparison of the best AI crypto trading bots out there. Now go forth and trade wisely. And for the love of all that is holy, don’t forget to use stop losses. Your future self will thank you!

Understanding AI Crypto Trading Bots

Alright, let’s break it down. AI crypto trading bots are like your personal trading assistants on steroids. They’re computer programs that use artificial intelligence to make trading decisions for you. But here’s the kicker – they’re not just following a set of rigid rules like traditional trading bots. Nope, these smart cookies can learn and adapt!

I remember when I first heard about trading bots, I thought, “Great, another complicated tech thing I need to figure out.” But trust me, AI-powered bots are a whole different ballgame. They’re like the cool, hip cousins of those old-school bots.

So, what makes these AI bots so special? Well, for starters, they can analyze massive amounts of data in seconds. I’m talking market trends, historical data, news sentiment – you name it. It’s like having a super-fast, super-smart researcher working for you 24/7.

But here’s where it gets really interesting. These bots can learn from their trades. They use machine learning algorithms to improve their strategies over time. It’s like they’re constantly leveling up, getting better and smarter with each trade.

For us beginners, this is huge! It means we can tap into sophisticated AI crypto trading strategies without needing a Ph.D. in finance. These bots can help us spot opportunities we might miss, react to market changes faster than humanly possible, and even manage risk more effectively.

And let’s be honest, we’ve all made those impulse trades based on FOMO or panic. Well, AI bots don’t have emotions. They stick to the strategy, which can help us avoid those costly emotional decisions. Trust me, my portfolio would’ve looked a lot healthier if I had used these bots from the start!

Factors to Consider When Choosing an AI Crypto Trading Bot

Okay, so you’re sold on the idea of AI crypto trading bots. Awesome! But now comes the tricky part – choosing the right one. Don’t worry, I’ve been there, and I’m going to share some key factors you should consider.

First up, ease of use. Let’s face it, we’re not all tech wizards. When I started, I wanted a bot that didn’t require a computer science degree to operate. Look for bots with user-friendly interfaces and clear instructions. Trust me, you’ll thank yourself later when you’re not pulling your hair out trying to figure out how to set up a simple trade.

Next, think about supported exchanges and cryptocurrencies. You want a bot that plays nice with the exchanges you use and the coins you’re interested in. I made the mistake of choosing a bot that didn’t support my favorite altcoin, and it was a real bummer.

Customization is another biggie. As you get more comfortable, you might want to tweak things. Look for bots that offer a range of strategies and the ability to customize them. It’s like having a Swiss Army knife instead of just a regular old pocket knife.

Now, let’s talk security. We’re dealing with real money here, folks. Make sure the bot has solid security features. Two-factor authentication, encryption – all that good stuff. I once used a bot with lackluster security, and let me tell you, those sleepless nights weren’t worth it.

Pricing is obviously important. Some bots charge a flat fee, others take a percentage of your profits. Do the math and see what makes sense for your trading volume. And hey, don’t forget to check if they offer a free trial. It’s a great way to test drive before committing.

Lastly, don’t underestimate the importance of good customer support and an active community. When you’re just starting out, having someone to turn to with questions can be a lifesaver. I’ve learned so much from community forums and responsive support teams.

Remember, the “best” bot is the one that fits your needs and trading style. It might take some trial and error, but hey, that’s all part of the journey!

How to Get Started with AI Crypto Trading Bots

Okay, so you’ve picked your bot. Now what? Don’t worry, I’ve got your back. Let’s walk through getting started with your shiny new AI trading buddy.

First things first, you need to set up your bot. Most bots these days are pretty user-friendly, but don’t be surprised if it takes a bit of time to get everything just right. It’s like setting up a new smartphone – a bit fiddly at first, but worth it in the end.

Next up, you’ll need to connect your bot to the exchanges you want to trade on. This usually involves creating API keys on your exchange and then entering them into your bot. It sounds technical, but it’s actually pretty straightforward. Just remember to never share your API keys with anyone!

Now, here’s a pro tip: start with paper trading. It’s like a flight simulator for trading. You get to test out strategies without risking real money. I know it’s tempting to dive right in, but trust me, paper trading can save you from some costly mistakes. I learned that the hard way!

When you’re setting up your first real trades, start small. I’m talking really small. Remember, this is all about learning. You can always scale up later when you’re more comfortable.

Oh, and don’t forget to set up some basic risk management. Set stop-losses, take-profits, and don’t invest more than you can afford to lose. Your bot might be smart, but it’s not psychic!

Finally, keep an eye on your bot, especially in the beginning. You want to make sure it’s behaving the way you expect. It’s like having a new pet – you need to supervise it at first!

Common Mistakes to Avoid When Using AI Crypto Bots

Alright, let’s talk about some pitfalls to watch out for. I’ve made plenty of mistakes in my bot trading journey, and I’m hoping you can learn from them!

First up, don’t fall into the trap of thinking your bot is infallible. I remember when I first started, I thought I could just set it and forget it. Big mistake! While these bots are smart, they’re not perfect. The market can be unpredictable, and no bot can account for every possible scenario.

Another biggie is neglecting risk management. Just because a bot is making the trades doesn’t mean you can throw caution to the wind. Always set stop-losses and don’t risk more than you can afford to lose. I once got a bit too confident and ended up with a much lighter wallet. Not fun!

Here’s a mistake I see a lot of beginners make: failing to monitor and adjust their strategies. The crypto market is always changing, and what works today might not work tomorrow. Keep an eye on your bot’s performance and be ready to tweak things if needed.

Oh, and don’t ignore market conditions! Your bot might be making all the right moves according to its strategy, but if the overall market is tanking, you might still end up in the red. Always keep an eye on the bigger picture.

Lastly, don’t get caught up in the hype of overly complex strategies. Sometimes, simpler is better, especially when you’re just starting out. I’ve seen people use strategies they don’t fully understand just because they sound impressive. Stick to what you know and understand!

The Future of AI in Crypto Trading

Wow, we’ve covered a lot of ground! But before we wrap up, let’s take a quick peek into the crystal ball and see what the future might hold for AI in crypto trading.

First off, I think we’re going to see some major leaps in machine learning and deep learning algorithms. These bots are going to get even smarter, able to analyze more data and spot patterns that even experienced human traders might miss. It’s both exciting and a little scary!

I’m also keeping my eye on the integration of natural language processing. Imagine a bot that can read and understand news articles, social media posts, and even regulatory announcements, then adjust its trading strategy accordingly. That’s some sci-fi level stuff right there!

Another trend I’m excited about is the democratization of AI trading. As these tools become more user-friendly and accessible, more and more regular folks like us will be able to take advantage of them. It’s like having a team of Wall Street quants in your pocket!

But here’s the thing – as AI becomes more prevalent in trading, it’s going to be crucial for us to stay informed and adaptable. The strategies that work today might not work tomorrow. Continuous learning is going to be key.

My advice? Stay curious. Keep learning about new developments in AI and crypto. Join online communities, attend webinars, read blogs. The more you understand, the better positioned you’ll be to take advantage of these amazing tools.

And who knows? Maybe someday we’ll have AI assistants that can explain complex trading strategies as easily as I’ve tried to explain AI trading bots to you today. Wouldn’t that be something?

Conclusion

Phew! We’ve covered a lot of ground today, haven’t we? From understanding what AI crypto trading bots are, to choosing the right one, to avoiding common pitfalls – it’s been quite a journey.

Let’s recap the key points:

- AI crypto trading bots can be a game-changer for beginners, helping us trade more efficiently and potentially more profitably.

- When choosing a bot, consider factors like ease of use, supported exchanges, customization options, security, pricing, and customer support.

- There are tons of great options out there, from user-friendly bots like 3Commas and Cryptohopper to more advanced platforms like Haasonline.

- Getting started is easier than you might think, but remember to start with paper trading and small real trades.

- Avoid common mistakes like over-relying on automation or neglecting risk management.

- The future of AI in crypto trading is exciting, with advancements in machine learning and natural language processing on the horizon.

Remember, while these bots are powerful AI crypto trading tools, they’re not magic money-making machines. They’re here to assist us, not replace our decision-making entirely. Always do your own research, understand the strategies you’re using, and never invest more than you can afford to lose.

I encourage you to start small, experiment with different bots and strategies, and find what works best for you. Everyone’s trading journey is unique, and what works for one person might not work for another.

And hey, I’d love to hear about your experiences! Have you tried any of these bots? Do you have any tips or tricks to share? Or maybe you’ve got questions about getting started? Drop a comment below and let’s keep this conversation going. After all, we’re all in this crazy crypto world together!

Happy trading, and may the odds (and the bots) be ever in your favor!