As we gear up for 2025, the crypto trading landscape continues to evolve at breakneck speed. In this high-stakes digital arena, trading bots have become essential tools for investors looking to stay ahead of the curve.

Two titans of automated trading, 3Commas vs Cryptohopper, stand out from the pack. But which one deserves a spot in your crypto arsenal?

In this deep dive, we’ll pit these powerhouse platforms against each other, examining everything from user experience to advanced features.

Which is Better, 3Commas or Cryptohopper?

When it comes to deciding whether 3Commas or Cryptohopper is better, there’s no one-size-fits-all answer. Both platforms have their strengths, and the best choice depends on your individual trading style, experience level, and specific needs. Let me break it down for you:

3Commas might be better if you:

- Prefer a more comprehensive, feature-rich platform

- Are looking for advanced DCA and GRID trading options

- Want a wider range of supported exchanges

- Value a large, active community for strategy sharing and support

Cryptohopper could be the better choice if you:

- Are interested in AI-powered trading strategies

- Enjoy a more visual, intuitive strategy designer

- Want strong backtesting and simulation features

- Like the idea of a marketplace for trading strategies

In my experience, 3Commas tends to be more beginner-friendly out of the gate, while Cryptohopper offers more customization for advanced users. 3Commas has a slight edge in exchange coverage, but Cryptohopper’s AI features are pretty impressive.

Remember, the “best” platform is the one that aligns with your trading goals and comfort level. I’d recommend giving both a try with their free trials or paper trading options. That way, you can get a feel for which interface and feature set works best for you.

Ultimately, both 3Commas and Cryptohopper are solid choices in the world of crypto trading bots. Your success will depend more on how well you use the tool, rather than which one you choose. Just remember to always do your own research, start small, and never invest more than you can afford to lose. Happy trading!

| Aspect | 3Commas | Cryptohopper |

|---|---|---|

| Overall Platform | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| User Interface and Ease of Use | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Trading Features and Strategies | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Supported Exchanges and Cryptocurrencies | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Backtesting and Paper Trading | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Pricing Plans and Value for Money | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Security Measures and Reliability | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Community and Educational Resources | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Performance and Profitability | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Official Website | Visit official Website | Visit official Website |

What Are 3Commas and Cryptohopper?

Okay, folks, let’s talk about 3Commas and Cryptohopper. Man, when I first dipped my toes into the crypto trading bot world, I felt like I was trying to read hieroglyphics! But trust me, once you get the hang of it, these tools are absolute game-changers.

So, what’s the deal with 3Commas? It’s like having a super-smart trading buddy who never sleeps. I remember setting up my first DCA (dollar-cost averaging) bot – it was a total lifesaver during that crazy market dip last year. While I was busy panicking, my little bot just kept calmly buying the dips. Talk about keeping your cool under pressure!

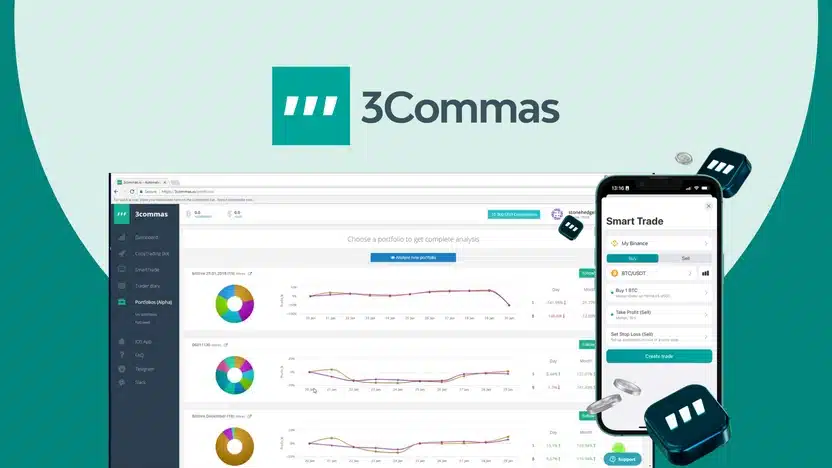

3Commas has been around since 2017, and they’ve really fine-tuned their platform. One of the coolest features? Their Smart Trading terminal. It’s like mission control for your trades. I once accidentally set a stop-loss way too high and almost had a heart attack, but the Smart Trading terminal made it super easy to fix my mistake. Phew!

Now, let’s chat about Cryptohopper. This new kid on the block is making waves with its AI-powered strategies. At first, I was like, “AI in my crypto trades? No way!” But curiosity got the best of me, and I gotta say, I’m impressed. Their marketplace of pre-made strategies is pretty slick. It’s like having a bunch of pro traders working for you 24/7.

One time, I decided to test Cryptohopper against my own trading skills. Let’s just say the bot put me to shame. It caught a pump on a small-cap coin that I completely missed while I was busy overthinking my next move. Lesson learned: sometimes it pays to trust the tech!

Now, here’s the kicker – these bots are part of this massive AI revolution in crypto trading. It’s wild! Did you know that algorithmic trading now accounts for over 80% of daily trading volume in the crypto market? That’s insane! Gone are the days when I used to manually place all my trades like some kind of caveman.

But let me tell you, it’s not all rainbows and unicorns. There was this one time I set up a bot without fully understanding the settings. Let’s just say I learned the hard way that you should always double-check your configuration. Oops!

The rise of these AI trading bots is really changing the game for us regular folks. It’s like we’ve got the same tools as the big players now. But here’s a pro tip: don’t just set it and forget it. You still gotta understand the market. These tools are awesome, but they’re not crystal balls.

I’ve found that combining the bots with some good old-fashioned market research works best. Like, I use 3Commas for my day-to-day trading, but I always keep an eye on market trends and news. It’s all about finding that sweet spot between automation and human intuition.

So, whether you’re a newbie or a seasoned trader, these bots can be total game-changers. Just remember to start small, use paper trading to practice, and never invest more than you can afford to lose. Trust me, your future self will thank you!

User Interface and Ease of Use

3Commas: ⭐⭐⭐⭐

Cryptohopper: ⭐⭐⭐⭐

Alright, let’s dive into the nitty-gritty of using these bad boys. First up, 3Commas’ dashboard. When I first logged in, I was like, “Whoa, information overload!” But you know what? After a couple of days, it all started to make sense.

The 3Commas dashboard is like the Swiss Army knife of crypto trading. Everything’s right there at your fingertips. I love how they’ve organized all the different bots and strategies. It’s pretty intuitive once you get the hang of it. There was this one time I accidentally created two identical bots (don’t ask), but it was super easy to spot and fix my mistake.

Navigation-wise, 3Commas is pretty smooth. I can jump from my portfolio overview to setting up a new bot in just a couple of clicks. It’s a lifesaver when the market’s going crazy and you need to act fast. Trust me, when you’re trying to catch a sudden pump, every second counts!

Now, Cryptohopper’s interface? It’s a whole different ball game. At first glance, it looks simpler than 3Commas, but don’t let that fool you. There’s a lot of power under the hood. The learning curve is a bit steeper, in my experience. I remember spending a whole weekend just figuring out how to set up my first strategy. But once it clicked? Man, it was like unlocking a secret level in a video game.

One thing I really appreciate about Cryptohopper is how they’ve designed their strategy designer. It’s visual and intuitive, even for someone like me who isn’t exactly a coding whiz. I’ve created some pretty complex strategies without writing a single line of code. How cool is that?

When it comes to mobile apps, both platforms have got you covered, but they’re not created equal. 3Commas’ mobile app is pretty robust. I can do almost everything on my phone that I can do on desktop. It’s saved my bacon more than once when I was out and about and needed to tweak a bot ASAP.

Cryptohopper’s mobile app, on the other hand, is more… let’s say, minimalist. It’s great for checking your stats and making quick adjustments, but for the heavy lifting, you’ll want to use the desktop version. I learned this the hard way when I tried to set up a complex strategy on my phone while waiting for my coffee. Let’s just say it didn’t end well, and I ended up with a cold latte.

Accessibility-wise, both platforms are doing a pretty good job. They’ve got dark modes (your eyes will thank you during those late-night trading sessions), and the layouts are generally clear and easy to read. But here’s a pro tip: invest in a good laptop or tablet. Trust me, trying to manage multiple bots on a tiny phone screen is a recipe for a headache.

All in all, both platforms have their strengths when it comes to user interface and ease of use. 3Commas feels more comprehensive out of the gate, while Cryptohopper has a bit of a learning curve but offers more customization. It really comes down to your trading style and what you’re comfortable with.

Remember, the best interface is the one that helps you make smart trading decisions without pulling your hair out. So take the time to explore both platforms, maybe even do some paper trading to get a feel for them. Your future, less-stressed self will thank you!

Trading Features and Strategies

3Commas: ⭐⭐⭐⭐⭐

Cryptohopper: ⭐⭐⭐⭐⭐

Let me tell you, when it comes to trading features, both 3Commas and Cryptohopper pack a serious punch. But they’ve each got their own special sauce, you know?

3Commas is like the Swiss Army knife of crypto trading. Their DCA (Dollar Cost Averaging) bot? It’s been my ride-or-die during market dips. I remember this one time when Bitcoin took a nosedive – I was freaking out, but my DCA bot just kept calmly buying the dips. Talk about keeping a cool head!

Then there’s the GRID bot. Oh boy, this one’s a game-changer for sideways markets. I used to hate those boring, flat periods, but now? It’s like printing money. Well, most of the time. There was this one instance where I set my grid too narrow and missed out on a sudden price jump. Lesson learned: always leave some room for volatility!

Cryptohopper, on the other hand, is all about that AI life. Their machine learning algorithms are pretty impressive. I was skeptical at first (I mean, who isn’t when AI is involved?), but after giving it a shot, I gotta say – it’s picked up on some patterns I never would’ve noticed.

One cool thing about Cryptohopper is their strategy marketplace. It’s like a buffet of trading strategies created by pros. I’ve found some real gems there. But word to the wise: always backtest before you commit real money. I learned that the hard way when I blindly followed a “guaranteed profit” strategy. Spoiler alert: there’s no such thing as guaranteed in crypto!

When it comes to automated trading, both platforms have got you covered. 3Commas lets you set up some pretty complex scenarios with their bot constructor. It’s like playing chess with the market. Cryptohopper, meanwhile, has this cool feature where you can mirror successful traders. It’s like having a pro trader in your pocket!

But here’s the thing – no matter how fancy these features are, they’re not magic wands. You’ve still gotta understand the market. I’ve had my fair share of facepalm moments when I realized I’d set up a bot to buy when I meant it to sell. Oops!

The key is to start small, test different strategies, and most importantly, never stop learning. These tools are powerful, but at the end of the day, you’re the one in charge. Use them wisely, and they can seriously up your trading game. Just don’t forget to take breaks and step away from the charts sometimes. Trust me, your sanity will thank you!

Supported Exchanges and Cryptocurrencies

3Commas: ⭐⭐⭐⭐⭐

Cryptohopper: ⭐⭐⭐⭐

Alright, let’s talk about where you can use these bad boys. When it comes to supported exchanges, both 3Commas and Cryptohopper have got you covered, but there are some differences you should know about.

3Commas has been in the game longer, and it shows in their exchange connections. Last time I checked, they supported a ton of major exchanges. I’m talking Binance, Coinbase Pro, Kraken, KuCoin – the list goes on. It’s like having a universal remote for your crypto trading!

I remember when I first started using 3Commas, I was amazed at how easy it was to connect my accounts. Well, mostly easy. There was this one time I messed up my API keys and spent a whole afternoon trying to figure out why my bot wasn’t trading. Pro tip: double-check those API permissions, folks!

Cryptohopper isn’t far behind in the exchange game. They’ve got connections to most of the big players too. What I like about Cryptohopper is how they’re always adding new exchanges. It seems like every time I log in, there’s a new option available.

Now, when it comes to supported cryptocurrencies, both platforms cast a wide net. You’ve got your big boys like Bitcoin and Ethereum, of course. But what about those obscure altcoins you’re eyeing? Well, it really depends on the exchange you’re using.

I’ve found that 3Commas tends to support whatever coins are available on your connected exchange. This came in handy when I wanted to trade some lesser-known tokens on KuCoin. My 3Commas bot handled it like a champ!

Cryptohopper is pretty similar in this regard. If the coin is on the exchange, chances are you can trade it through Cryptohopper. But here’s a heads up: liquidity can be an issue with some of the more obscure coins. I learned this the hard way when I tried to run a high-frequency strategy on a low-volume altcoin. Let’s just say it didn’t go as planned!

One thing to keep in mind is market coverage. While both platforms cover a lot of ground, you might find some differences in how they handle certain markets. For example, I’ve found that 3Commas has a slight edge when it comes to futures trading on some exchanges.

Liquidity is another factor to consider. Both platforms will let you trade on major markets without a hitch. But when you start dabbling in smaller cap coins or less popular trading pairs, that’s when you might notice some differences. Always check the order books before you let your bots loose!

At the end of the day, whether you go with 3Commas or Cryptohopper, you’re likely to find support for your favorite exchanges and coins. Just remember to do your homework, especially if you’re planning to trade some off-the-beaten-path cryptocurrencies. And always, always keep an eye on those trading fees! They can sneak up on you faster than a bull run!

Backtesting and Paper Trading

3Commas: ⭐⭐⭐⭐

Cryptohopper: ⭐⭐⭐⭐⭐

Alright, let’s talk about one of my favorite features: backtesting and paper trading. Trust me, these are lifesavers when you’re trying to nail down a winning strategy without risking your hard-earned crypto.

First up, 3Commas. Their historical data analysis tools? Pretty solid. I remember spending a whole weekend backtesting different DCA strategies. It was like being a mad scientist, but with charts instead of beakers! The cool thing about 3Commas is how they let you tweak parameters on the fly. I’ve caught myself saying “just one more test” more times than I care to admit.

One time, I thought I’d found the holy grail of trading strategies. The backtesting results were off the charts! But when I ran it through their paper trading simulator, reality hit hard. Turns out, my strategy couldn’t handle sudden market swings. Lesson learned: always double-check with paper trading!

Now, Cryptohopper’s backtesting features? They’re no slouch either. What I really dig about Cryptohopper is their simulation feature. It’s like watching a time-lapse of your trading strategy in action. I’ve caught so many potential mistakes this way.

There was this one strategy I was sure was going to make me rich. The backtesting looked amazing. But when I ran the simulation, I realized it was making way too many trades. The fees would’ve eaten up all my profits! Talk about dodging a bullet.

Both platforms offer paper trading, and let me tell you, it’s a game-changer. It’s like training wheels for your trading strategies. You get all the excitement of real trading, but without the risk of losing your shirt.

I can’t stress enough how important risk-free trading practice is. It’s like a sandbox where you can make all the mistakes you want. And trust me, you will make mistakes. I sure did! But it’s way better to lose fake money than real money, right?

One pro tip: treat your paper trading like it’s real. I used to be super reckless with my paper trades, taking risks I’d never take with real money. But that doesn’t help you in the long run. Use paper trading to develop good habits and realistic expectations.

Remember, no matter how good your backtesting results look, the market can always throw you a curveball. I’ve had strategies that looked perfect on paper fall apart in real trading. That’s why it’s crucial to use both backtesting and paper trading before you risk real funds.

So whether you’re a newbie just starting out or a seasoned trader testing a new strategy, make backtesting and paper trading your best friends. They might not be as exciting as real trading, but they can save you from some expensive lessons. Trust me, your future self (and your wallet) will thank you!

Pricing Plans and Value for Money

3Commas: ⭐⭐⭐⭐

Cryptohopper: ⭐⭐⭐⭐

Okay, let’s talk about everyone’s favorite topic – money! Specifically, how much you’ll need to shell out for 3Commas and Cryptohopper. Buckle up, because this is where things get interesting.

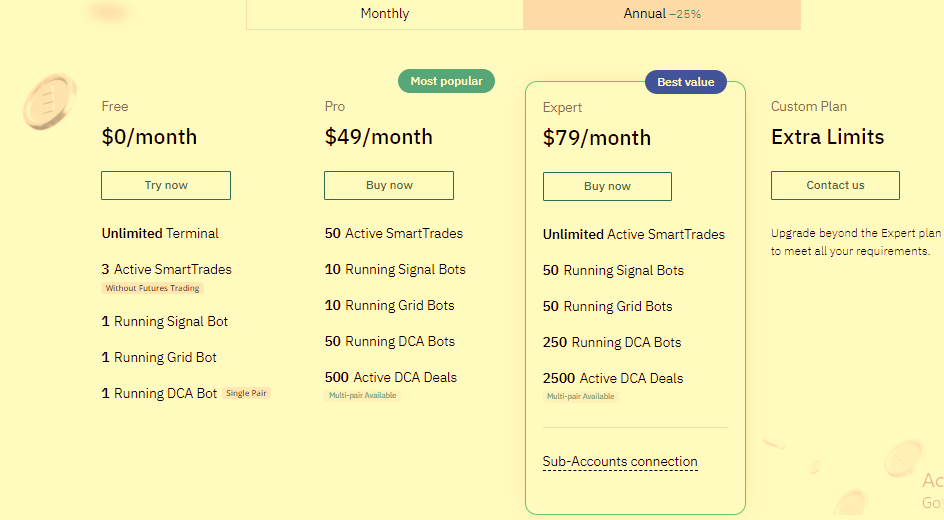

3Commas has this tiered subscription model that reminds me of those “choose your own adventure” books. You’ve got your basic plan, which is great for dipping your toes in the water. Then there’s the advanced plan, which is where the real fun begins. And for the high rollers, there’s the pro plan.

I started with the basic plan, thinking I’d save a few bucks. Big mistake! I quickly realized I needed some of the advanced features. It was like trying to win a drag race with a bicycle. Sure, you can do it, but why make life hard for yourself?

The cool thing about 3Commas is that they often run promotions. I snagged a sweet deal on their annual pro plan during a Black Friday sale. It felt like Christmas came early! Just keep an eye out for those deals, they can save you a bundle.

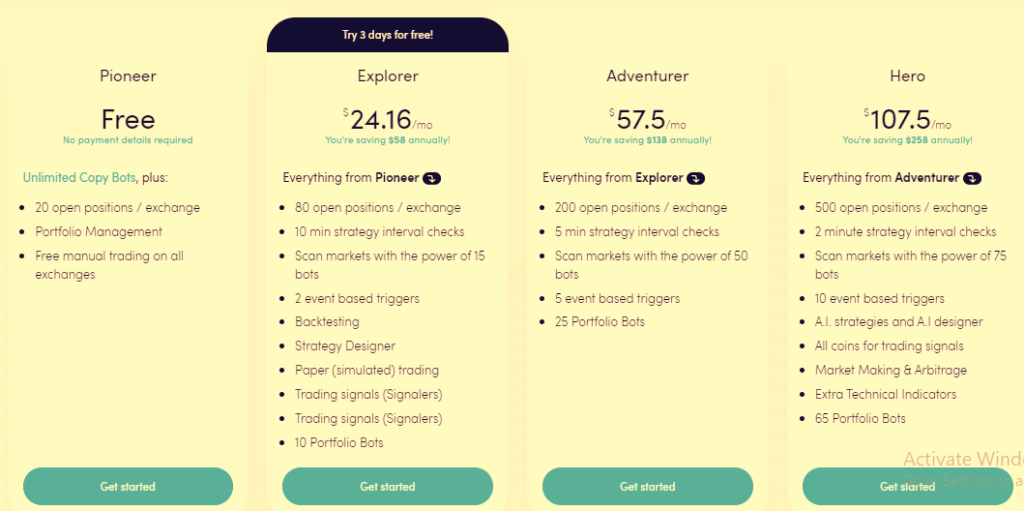

Now, Cryptohopper’s pricing structure is a bit different. They’ve got this marketplace model where you can buy or rent bots and strategies. It’s like a farmer’s market, but for trading algorithms. Pretty neat, right?

I remember the first time I rented a “pro” strategy. I felt like a kid in a candy store! But here’s a pro tip: always check the reviews and performance history before you buy. I once got burned by a strategy that looked great on paper but flopped in real trading.

When it comes to cost-effectiveness, it really depends on your trading style. If you’re a set-it-and-forget-it kind of trader, 3Commas might give you more bang for your buck. But if you love tinkering and trying new strategies, Cryptohopper’s marketplace could be your playground.

For beginners, I’d say start with the basic plans on either platform. You can always upgrade later. Trust me, it’s better to start small and work your way up. I learned this the hard way when I jumped into an expensive plan and then realized I wasn’t using half the features.

If you’re an active trader dealing with larger volumes, the higher-tier plans start to make more sense. The advanced features can potentially save you more than the cost of the subscription. It’s like buying in bulk – spend more to save more.

One thing to keep in mind: don’t just look at the sticker price. Consider the potential returns and time saved. I used to spend hours manually placing trades. Now, my bots do the heavy lifting, and I can actually have a life outside of watching charts all day.

Remember, the most expensive plan isn’t always the best for you. It’s all about finding that sweet spot where the features match your needs without breaking the bank. And hey, both platforms offer free trials, so don’t be afraid to take them for a spin before you commit!

At the end of the day, whether 3Commas or Cryptohopper offers better value for money depends on your trading goals, style, and budget. Just like with trading itself, do your research, start small, and don’t be afraid to adjust your strategy as you go along. Happy trading, and may the crypto gods smile upon your wallet!

Security Measures and Reliability

3Commas: ⭐⭐⭐⭐

Cryptohopper: ⭐⭐⭐⭐

Alright, let’s talk about the elephant in the room – security. When you’re dealing with crypto, this stuff is no joke. It’s like leaving your house – you wouldn’t go out without locking the door, right?

3Commas has been around the block a few times, and it shows in their security setup. They’ve got this nifty thing called “3Commas Secret” – it’s like a secret handshake between your exchange and the platform. I remember when I first set it up, I felt like a spy in a movie!

But here’s the thing – even with all these fancy security measures, you’ve gotta do your part. I learned this the hard way when I used the same password for everything (rookie mistake, I know). Let’s just say it was a wake-up call.

Cryptohopper’s not slacking in the security department either. They’ve got two-factor authentication, IP whitelisting, the works. It’s like Fort Knox, but for your crypto.

Now, when it comes to reliability, both platforms are pretty solid. But let’s be real – no system is perfect. I’ve had a few heart-stopping moments with both platforms when the market was going crazy and I couldn’t log in. Talk about stress!

3Commas has generally been pretty stable in my experience. But there was this one time during a big market dip when everything went haywire. My bots were acting up, and support was swamped. It felt like being in a boat during a storm!

Cryptohopper’s had its hiccups too. I remember this one update that threw all my settings out of whack. Spent a whole day reconfiguring everything. Not fun.

Customer support is crucial when things go south. 3Commas has been pretty responsive in my experience. Cryptohopper’s support is good too, but sometimes it feels like they’re speaking a different language. Maybe it’s just me?

Bottom line – both platforms take security seriously, but always, ALWAYS use strong passwords and enable two-factor auth. And maybe keep a stress ball handy for those inevitable glitches!

Community and Educational Resources

3Commas: ⭐⭐⭐⭐⭐

Cryptohopper: ⭐⭐⭐⭐

Let’s chat about the social side of things. Because let’s face it, crypto can be lonely if you’re just staring at charts all day!

3Commas has this awesome community forum. It’s like a watering hole for crypto enthusiasts. I’ve picked up so many tips there, it’s insane. There was this one user who shared a GRID strategy that totally changed my game. Thanks, CryptoWizard92!

Their learning materials are pretty solid too. Tutorials, webinars, you name it. I binge-watched their video series like it was Netflix. Who knew learning about stop-loss orders could be so entertaining?

Cryptohopper’s got a different vibe. Their community is more focused on strategy sharing. It’s like a potluck, but instead of casseroles, people bring trading algorithms. Their tutorial section is a goldmine too. I still refer back to it when I’m setting up complex strategies.

Both platforms run webinars regularly. I try to catch them when I can – it’s like a free masterclass. Plus, you get to ask questions in real-time. Just don’t be that guy who asks about price predictions every five minutes!

The peer support on both platforms is incredible. It’s like having a team of trading buddies available 24/7. I’ve had fellow users help me troubleshoot issues at 2 AM. Crypto never sleeps, and neither do these communities!

One thing I love is how both platforms encourage continuous learning. In this market, if you’re not learning, you’re falling behind. Trust me, I learned that lesson the hard way when I ignored DeFi for too long. Talk about missing the boat!

Remember, though – always take advice with a grain of salt. Not everyone in these communities is an expert, even if they sound like one. Do your own research, and never risk more than you can afford to lose. Happy learning, folks!

Performance and Profitability

3Commas: ⭐⭐⭐⭐

Cryptohopper: ⭐⭐⭐⭐

Okay, let’s get down to brass tacks – performance and profitability. After all, we’re not in this for the tech (okay, maybe a little), we’re in it to make some gains!

With 3Commas, I’ve seen some pretty impressive results. There was this one DCA bot I set up that just crushed it during a bull run. I felt like a genius! But let’s be real – there have been some duds too. That GRID bot I set up during a super volatile week? Yeah, let’s not talk about that.

The cool thing about 3Commas is how they let you share your bot performance. It’s like showing off your high score in a video game, but with real money. I’ve picked up some killer strategies this way.

Cryptohopper’s got some serious algo game. Their AI-powered strategies have pulled off some moves that made my jaw drop. But here’s the kicker – past performance doesn’t guarantee future results. I learned that the hard way when I blindly followed a “hot” strategy right into a loss.

Both platforms have their fair share of success stories. I’ve seen screenshots of gains that made my eyes pop. But remember, people are more likely to share their wins than their losses. It’s like social media – everyone’s life looks perfect until you see behind the scenes.

Now, let’s talk about the factors that affect bot profitability. Market conditions are huge. A strategy that prints money in a bull market might bleed you dry when the bears take over. I’ve had to learn to adapt my bots to different market conditions. It’s like gardening – you’ve gotta know when to plant and when to harvest.

Your risk tolerance plays a big role too. I used to set my stop-losses super tight, thinking I was being smart. All I did was guarantee a bunch of small losses. Finding that sweet spot between risk and reward is key.

And let’s not forget about fees! They can eat into your profits faster than you can say “to the moon”. I always factor in fees when I’m backtesting a strategy. Ignore them at your peril!

One last thing – don’t expect miracles. These bots are tools, not magic wands. They can amplify your trading strategy, but they can’t create profits out of thin air. I’ve seen people blow up their accounts thinking bots would make them overnight millionaires. Spoiler alert: it doesn’t work that way.

At the end of the day, your mileage may vary. What works for one trader might not work for another. It’s all about finding the right strategy for your goals and risk tolerance. And remember – in crypto, the only constant is change. Stay adaptable, keep learning, and may your candles always be green!

Frequently Asked Questions (FAQ)

Is there a free version of 3Commas?

Is there a free version of 3Commas? While 3Commas offers various subscription plans, it does provide limited features for free users. For those seeking the best crypto trading experience, upgrading is often recommended.

3Commas also stands out as a comprehensive crypto trading platform, enabling users to automate their strategies effectively. In contrast, Cryptohopper focuses on individual trading, catering to specific user preferences.

Are 3Commas bots profitable?

3Commas is a comprehensive crypto trading platform that offers automated bots designed to enhance trading strategies. These bots can be highly compatible with various exchanges, allowing users to optimize their trades. While many users report profitability, results can vary based on market conditions and individual trading strategies.

How effective is Cryptohopper?

Cryptohopper has proven to be an effective automated trading bot for cryptocurrency trading, particularly in 2025. When doing a comparison of Cryptohopper vs 3commas, users often note that Cryptohopper provides superior accuracy in signal generation and indicator usage.

Additionally, Cryptohopper supports multi-exchange integration, allowing for seamless arbitrage opportunities. For those seeking passive income, Cryptohopper has a reserved funds feature that aids in management of portfolio risk, making it a compelling choice when considering Cryptohopper and 3commas for tax efficiency.

Ultimately, the choice of Cryptohopper vs 3commas vs other platforms hinges on personal preferences and specific trading goals, but Cryptohopper’s metrics for success are hard to ignore in the evolving landscape of cryptocurrency trading.