Delving into the world of stock trading is like stepping onto a stage where the stakes are high, and the plot twists unfold in real time.

As an investor myself, I fully grasp the importance of finding trustworthy allies in the midst of this financial drama. Today, I am thrilled to unveil my visionary perspectives on the most exceptional AI investment bots – an innovation that has revolutionized my approach to the market.

In this review, we will cut through the technical terms and focus on the key elements, delving into how these bots have evolved into more than just tools: they have become strategic partners that expertly navigate the complex world of the stock market.

What Are The Best AI investing bots

The emergence of AI investing bots has opened up a world of possibilities in the ever-changing field of stock trading.

Today, we will delve into the top 10 AI investing bots, analyzing their main advantages, pricing models, and the underlying strengths and weaknesses they possess.

1. Trade Ideas

Trade Ideas stands as a beacon of innovation in the financial landscape and is recognized as one of the best AI investing bot solutions. Renowned for its advanced AI stock trading bot and robust trading system, Trade Ideas offers traders a comprehensive platform for navigating the complexities of the stock market.

Key Benefits

- Intelligent Scanning: Utilizes advanced scanning algorithms to analyze real-time market data, helping traders identify potential opportunities based on specific criteria.

- Artificial Intelligence (AI): Incorporates AI-driven analytics to assess market patterns and trends, providing traders with data-driven insights for informed decision-making.

- Strategy Testing: Allows traders to backtest their strategies using historical data, enabling them to assess the effectiveness of their approaches and make informed adjustments.

- Customizable Alerts: This enables users to set up personalized alerts based on predefined criteria, ensuring they stay informed about significant market events that align with their trading.

Pricing

Trade Ideas offers a variety of pricing plans to cater to different trader needs. While specific details may be subject to change, the pricing typically includes options for monthly and annual subscriptions. Each subscription tier provides varying access levels to features, tools, and data feeds.

Additionally, Trade Ideas may offer a free trial period, allowing users to explore the platform’s capabilities before committing to a subscription.

It’s recommended to check the official Trade Ideas website for the latest and most accurate information on pricing, including any promotional offers or discounts that may be available.

Pros & Cons

Pros of Trade Ideas:

- Trade Ideas stands out with its dynamic scanning algorithms that swiftly analyze real-time market data, offering traders a competitive edge in identifying potential opportunities.

- The integration of artificial intelligence elevates market analysis by discerning intricate patterns and trends, providing traders with nuanced, data-driven insights.

- Traders benefit from a robust strategy testing feature, enabling them to simulate and refine their trading approaches with historical data for optimal performance.

- The platform’s customizable alert system empowers users to set personalized notifications based on specific criteria, ensuring timely awareness of critical market shifts aligned with their strategies.

Cons of Trade Ideas:

- One potential drawback is the perceived complexity of the pricing structure, which may require users to carefully navigate the options to align with their specific needs.

- Despite its user-friendly interface, there might be a learning curve for users, especially those new to AI-driven analytics and sophisticated scanning technologies.

- As an online platform, Trade Ideas depends on a stable internet connection. This may pose challenges for users in regions with unreliable connectivity.

- Depending on the selected plan, the subscription cost may be higher than more basic trading tools, potentially impacting budget-conscious traders.

2. Tickeron

Tickeron is a leading financial platform renowned for its cutting-edge tools, including its AI trend prediction engine. This engine is the core of Tickeron’s capabilities, providing users with sophisticated insights into stock prices and market trends. The platform goes beyond traditional offerings with its AI investment bot, allowing users to implement strategic decisions seamlessly. With its innovative features, Tickeron emerges as a dynamic solution for traders seeking a technological edge in the ever-evolving world of finance.

Key Benefits

- Advanced AI Trend Prediction Engine: Tickeron’s platform is powered by a state-of-the-art AI trend prediction engine, providing users with accurate and data-driven insights into market trends.

- Automated Trading Bot: Tickeron offers the convenience of an automated bot, enabling users to execute strategic trades seamlessly based on the platform’s advanced analytics.

- Precise Stock Price Insights: Users benefit from accurate and real-time stock price insights, allowing for informed decision-making and timely actions in response to market fluctuations.

- Comprehensive Stock Analysis Software: Tickeron’s comprehensive stock analysis software equips users with advanced tools for in-depth market analysis, empowering them to make well-informed investment decisions.

- User-Friendly Interface: The platform boasts a user-friendly interface, ensuring accessibility for novice and experienced traders and enhancing overall trading.

- Dynamic Market Insights: Tickeron provides active and up-to-date market insights, keeping users abreast of changing market conditions and potential opportunities.

- Strategic Trading Decisions: With its advanced analytics and trading capabilities, Tickeron enables users to make strategic decisions aligned with their investment goals.

- Innovative Technological Edge: Tickeron stands out for its creative technological edge, positioning itself as a valuable resource for traders seeking a competitive advantage in the financial markets.

Pricing

Visit their official website or contact customer support directly to obtain the most accurate and up-to-date information regarding Tickeron’s pricing, including subscription plans, features included, and any potential additional costs. They typically provide detailed and current information about their offerings.

Pros & Cons

Pros:

- Enhanced Decision-Making: Tickeron’s AI investment bot software empowers users with advanced analytics, significantly improving their ability to make well-informed decisions.

- Automated Trading Efficiency: The platform allows users to automate their trading strategies, streamlining execution and enhancing overall trading efficiency.

- Market Insight: Tickeron provides valuable market insights, enabling users to stay informed and make strategic moves to improve their trades.

- User-Friendly Interface: With an intuitive and user-friendly interface, Tickeron ensures accessibility for traders looking to enhance and automate their trading practices.

Cons:

- Learning Curve: Users may face a learning curve, particularly when exploring the advanced features of the AI stock trading bot software and trading functionalities.

- Cost Considerations: Depending on individual budget constraints, some users may find the pricing structure of Tickeron relatively higher than more basic trading platforms.

- Market Dependency: Like any trading platform, market conditions may influence Tickeron’s effectiveness, and users should be aware of potential dependencies on external factors.

3. Signal Stack

Signal Stack emerges as a groundbreaking platform at the intersection of cutting-edge AI investment bot technologies and options trading. Geared toward traders seeking to leverage AI for enhanced decision-making, Signal Stack offers a dynamic environment to trade stocks and delve into the complexities of options trading.

Key Benefits

- AI Software Integration: Signal Stack distinguishes itself by the seamless integration of advanced AI apps. This powerful technology is harnessed to analyze market data, identify trends, and provide users with data-driven insights for more informed decisions.

- Options Trading Focus: Explicitly tailored for options enthusiasts, Signal Stack provides a specialized platform where traders can explore various options strategies. The incorporation of artificial technologies further enhances the precision and efficiency of trading.

- Innovative Use of AI: Signal Stack stands out for its creative use of AI, going beyond conventional approaches to amplify trading. Traders can harness the capabilities of AI to navigate the dynamic nature of the stock market and make strategic moves in the options space.

- User-Friendly Environment: Despite its advanced features, Signal Stack ensures a user-friendly environment, making it accessible to seasoned traders and those new to utilizing AI technologies in their strategies.

Pricing

To obtain the most accurate and current pricing information, visit the official Signal Stack website or contact their customer support directly. They can provide detailed information about their subscription plans, features, and associated costs.

Pros & Cons

Pros:

- Intuitive App Interface: Signal Stack features an intuitive app interface, enhancing accessibility for traders of all experience levels.

- Advanced AI Bot: The inclusion of an advanced AI bot distinguishes Signal Stack, providing users with powerful analytics and decision-making capabilities.

- Robust Algorithmic Trading Tools: Signal Stack offers powerful algorithmic trading, enabling users to use algorithmic trading for efficient execution.

- Optimized for Best Trading: Positioned as a platform for the best experience, Signal Stack emphasizes features and functionalities designed to enhance overall trading performance.

Cons:

- Learning Curve: Users may encounter a learning curve, particularly when navigating the advanced features of the AI stock trading bot and delving into trading.

- Potential App Dependency: As with any app-dependent platform, Signal Stack’s effectiveness may be subject to occasional technical issues or disruptions, affecting the user experience.

- Varied Subscription Costs: Depending on the chosen plan, users may find the subscription costs relatively higher, potentially influencing those seeking more budget-friendly options.

With its intuitive app, advanced artificial intelligence bot, and emphasis on trading for the best experience, Signal Stack caters to traders seeking a comprehensive and technologically advanced platform.

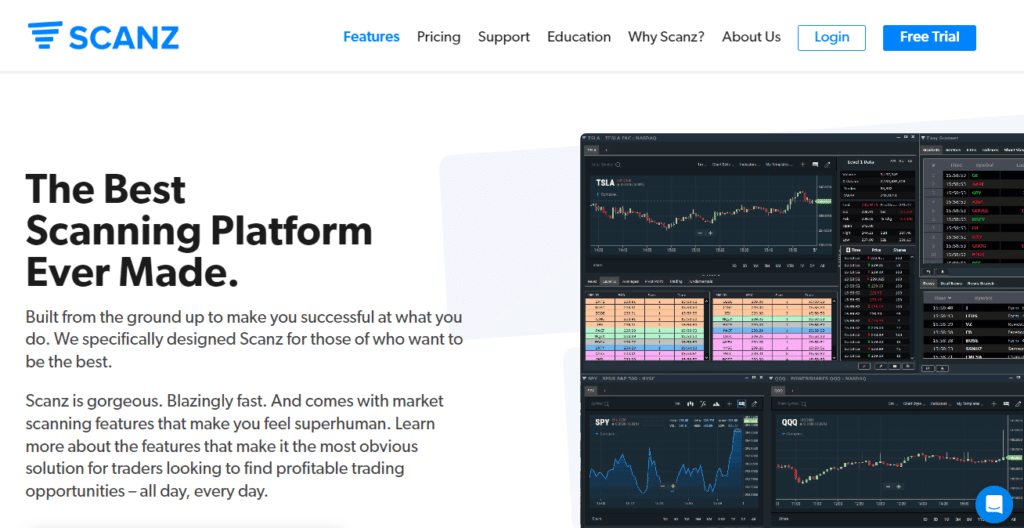

4. Scanz

Scanz is a pioneering force in the financial landscape, offering traders a robust and innovative automated trading platform. Renowned for its advanced capabilities, Scanz positions itself as a go-to solution for traders seeking efficiency and precision in their strategies. At the heart of Scanz’s offerings is its distinction as the best AI stock trading bot, a cutting-edge tool that empowers users to automate and optimize their decisions. With the ability to analyze millions of trading scenarios overnight, Scanz revolutionizes trading, providing users with a powerful platform to navigate the complexities of the financial markets.

Key Benefits

- Dynamic Scanning Capabilities: Scanz offers dynamic scanning tools, allowing traders to swiftly identify potential opportunities in the market based on their specified criteria.

- Real-time Market Data: Users benefit from real-time market data, ensuring that they have access to the latest information for informed decision-making.

- Customizable Alerts: The platform allows users to set up customizable alerts, keeping them notified of significant market movements or conditions aligned with their trading strategies.

- Advanced Technical Analysis: Scanz provides advanced technical analysis tools, charts, and indicators, enabling traders to conduct in-depth analyses and gain deeper insights into market trends.

- User-Friendly Interface: With a user-friendly interface, Scanz ensures an intuitive and accessible experience for traders of varying experience levels.

- Efficient Strategy Testing: Traders can efficiently test and optimize their strategies using Scanz, helping refine their approaches and improve overall trading performance.

- Multi-Platform Access: Scanz offers flexibility with multi-platform access, allowing users to engage with the platform across various devices for seamless trading.

- Comprehensive Market Coverage: The platform facilitates comprehensive market coverage, empowering users to explore various assets and markets to diversify their trading portfolio.

Pricing

To get the most accurate and up-to-date information on Scanz’s pricing, including subscription plans, features included, and any potential additional costs, I recommend visiting their official website or contacting customer support directly.

Pros & Cons

Pros:

- AI Stock Trading Tools: Scanz integrates advanced AI stock trading tools, providing users with sophisticated analytics and insights to enhance their decision-making.

- Identify Trading Opportunities: The platform excels in helping users identify trading opportunities efficiently through its dynamic scanning capabilities and real-time market data.

- User-Friendly Interface: Scanz ensures a user-friendly interface, making it accessible for traders of all experience levels to navigate and utilize its powerful tools.

- Efficient Strategy Testing: Traders can efficiently test and optimize their strategies using Scanz, allowing for strategic refinement and improved overall trading performance.

Cons:

- Learning Curve: Some users may experience a learning curve, especially when delving into the advanced features and tools available on the platform.

- Subscription Costs: Depending on individual preferences and budget constraints, users may consider subscription costs when opting for advanced features offered by Scanz.

- Market Dependency: Like any stock trading platform, market conditions may influence Scanz’s effectiveness, and users should be mindful of potential dependencies on external factors.

5. TrendSpider

TrendSpider emerges as a dynamic force in the financial realm, positioning itself as a cutting-edge trading platform that seamlessly integrates advanced technologies. As a sophisticated trading platform, TrendSpider caters to the diverse needs of traders, offering an intuitive interface and a suite of tools for technical analysis and charting.

Key Benefits

- Intuitive Automation: TrendSpider’s automated analysis and dynamic trendlines simplify the technical analysis process, saving time for traders.

- Advanced Charting: A comprehensive set of advanced charting tools empowers users to visualize market data with precision and clarity.

- Customizable Alerts: Tailor alerts based on specific indicators or price movements to stay informed about crucial market developments.

- User-Friendly Interface: Designed for beginners and experienced traders, TrendSpider offers an intuitive interface for efficient navigation.

- Multi-Timeframe Analysis: Conduct thorough analysis by examining market trends across multiple timeframes, providing a holistic perspective.

- Backtesting Capabilities: Test trading strategies against historical data to refine approaches and make data-driven decisions.

Pricing

TrendSpider offers a tiered pricing structure to cater to various trader needs. The pricing plans are designed to provide flexibility and scalability, allowing users to choose a program that aligns with their trading requirements.

While specific details may be subject to change, the pricing typically includes options for monthly or annual subscriptions. Users can select from different tiers, each offering a varying range of features and capabilities, such as access to advanced charting tools, automation features, and additional data feeds.

TrendSpider often provides a free trial period for users to explore the platform before committing to a subscription. It’s recommended to check the official TrendSpider website for the most up-to-date pricing information and details on each subscription tier.

Pros & Cons

Pros of TrendSpider:

- Leverages intelligent automation for dynamic trendlines and automated technical analysis, streamlining trading decisions.

- Provides a rich set of advanced charting tools, facilitating detailed market analysis.

- Customizable alerts based on specific indicators or price movements, ensuring timely awareness of market shifts.

- Designed for user-friendliness, catering to both beginners and experienced traders for efficient navigation.

- Allows for multi-timeframe analysis, offering a comprehensive view of market trends.

Cons of TrendSpider:

- The platform’s advanced features may pose a learning curve, particularly for users new to technical analysis and automation.

- Relies on a stable internet connection, potentially limiting usage in areas with unreliable connectivity.

- Depending on the chosen plan, some users might find the subscription cost higher than other tools.

- The tiered pricing structure may be complex, requiring careful consideration of features and costs for optimal selection.

6. StockHero

StockHero emerges as a transformative force in the stock trading landscape, bringing forth various innovative features to redefine the trading experience. At its core is an advanced AI stock trading bot, a sophisticated tool meticulously designed to navigate the complexities of the market with precision and efficiency. This AI-driven platform operates seamlessly, empowered by a cutting-edge trading algorithm that enhances decision-making and strategy execution.

Key Benefits

- AI Trading Bot: StockHero’s AI stock trading bot stands as the linchpin of its offerings. This intelligent tool automates trading processes, adapting to market trends and ensuring traders are presented with opportunities aligned with their preferences.

- Innovative Software: The platform integrates AI stock trading software that goes beyond traditional methods. This dynamic software learns from market patterns, providing valuable insights to optimize strategies and enhance overall trading.

- Seizing Trade Opportunities: StockHero is dedicated to uncovering trade opportunities in real time. The platform identifies potential trades through vigilant analysis of market trends, empowering users to capitalize on favorable market movements.

- Sophisticated Trading Algorithm: Powering StockHero is a sophisticated trading algorithm meticulously crafted through data-driven insights. This algorithm empowers users to make informed decisions, navigate market complexities, and strategically execute trades.

Pricing

Trade Ideas offers a flexible and tiered pricing structure to accommodate various trading needs. Traders can choose from different subscription plans, each tailored to provide varying levels of access to the platform’s features and tools.

Pros & Cons

Pros:

- Precise Trade Signals: StockHero provides accurate and timely trade signals, offering users valuable insights for strategic decision-making.

- Advanced AI Robot: The integration of a sophisticated AI robot sets StockHero apart, automating processes and enhancing trading with intelligent analysis.

- Robust Stock Analysis: StockHero equips traders with powerful tools for in-depth analysis, facilitating a comprehensive understanding of market trends.

- Tailored for Day Trading: Well-suited for day traders, StockHero caters to the fast-paced nature of day trading, providing real-time data and analysis for quick and informed decision-making.

Cons:

- Learning Curve: Some users may experience a learning curve, especially when navigating the advanced features of the AI robot and stock analysis tools.

- Potential Dependency on Technology: As an online platform, StockHero may be subject to occasional technical glitches or internet connectivity issues, impacting the user experience.

- Subscription Costs: Depending on the chosen plan, users may find the subscription costs relatively higher, especially when compared to more basic trading.

7. TradingView

TradingView stands as a versatile platform at the forefront of online trading, offering a comprehensive suite of tools to traders aiming to improve their trade strategies. Tailored for manual trading enthusiasts and those seeking to refine their trading style, TradingView provides a dynamic environment where users can analyze trading scenarios and make informed decisions.

Key Benefits

- Manual Trading Capabilities: TradingView caters to traders who prefer manual trading, providing a user-friendly interface that supports seamless execution of trades based on individual preferences and strategies.

- Enhance Your Trade: The platform empowers users to improve their trade practices by offering diverse technical analysis tools, charts, and indicators for a comprehensive understanding of market dynamics.

- Diverse Trading Styles: Recognizing the diversity in trading, TradingView accommodates various approaches, allowing traders to customize their experience based on their unique preferences and strategies.

- Scenario Analysis: Traders can benefit from the platform’s scenario analysis capabilities, enabling them to simulate different trading scenarios and assess potential outcomes before making decisions.

Pricing

TradingView offers a flexible pricing structure designed to accommodate various trader needs. While the platform provides free access to essential features, it offers subscription plans with additional functionalities for users seeking more advanced tools and capabilities. The pricing tiers cater to different levels of traders, providing options based on individual preferences and requirements. Traders can choose a plan that aligns with their trading goals and budget considerations, making TradingView accessible to beginners and experienced financial market professionals.

Pros & Cons

Pros:

- Versatile Charting Tools: TradingView offers versatile charting tools, empowering users with comprehensive technical analysis features to enhance their decisions.

- User-Friendly Interface: The platform boasts a user-friendly interface, providing traders, regardless of experience level, with easy navigation and accessibility to various tools and functionalities.

- Scenario Analysis: TradingView supports scenario analysis, allowing users to simulate and assess different trading scenarios to make more informed and strategic decisions.

- Diverse Trading Styles: Recognizing the diversity in styles, TradingView accommodates various approaches, ensuring that traders can tailor the platform to their unique preferences and strategies.

Cons:

- Learning Curve: Some users may experience a learning curve, particularly when delving into the advanced features and functionalities of TradingView’s charting tools and analysis capabilities.

- Premium Subscription Costs: While basic features are free, the cost of premium subscription plans with advanced tools may be a consideration for traders on a budget or those seeking more cost-effective options.

- Market Data Delay: Users of the free version may experience slight delays in real-time market data, impacting the timeliness of trade execution and decision-making.

TradingView’s strengths lie in its versatility, user-friendly design, and support for various styles. However, users should be mindful of the learning curve potential costs associated with premium features and consider the impact of market data delays based on their trading preferences.

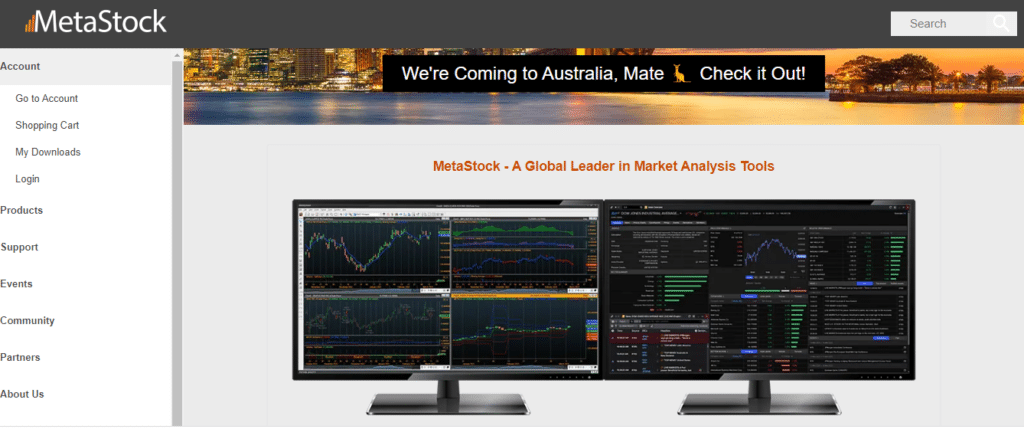

8. MetaStock

MetaStock is a prominent name in trading platforms, seamlessly transforming informed decisions into executed orders. Renowned for its advanced features and analytical tools, MetaStock has solidified its position in the list of the best AI bots for stock trading. With a user-friendly interface and powerful capabilities, MetaStock empowers traders to convert their market insights into actionable strategies, facilitating precise and efficient execution of trades.

As a comprehensive tool for technical analysis and strategy development, MetaStock continues to be a go-to solution for traders seeking a robust platform that bridges the gap between informed decisions and successful trading outcomes.

Key Benefits

- Advanced Analytical Tools: MetaStock offers advanced analytical tools, providing traders in-depth insights into market trends and conditions.

- Precise Technical Analysis: The platform excels in accurate technical analysis, enabling users to make informed trading decisions based on comprehensive market data.

- Efficient Strategy Development: Traders can efficiently develop and optimize their trading strategies using MetaStock’s powerful tools, enhancing the effectiveness of their approaches.

- User-Friendly Interface: With a user-friendly interface, MetaStock ensures accessibility for traders of varying experience levels, fostering a seamless and intuitive trading experience.

- Seamless Execution of Trades: MetaStock seamlessly transforms informed decisions into executed orders, facilitating efficient and timely implementation of trading strategies.

- Integration of AI App: Recognized among the best AI apps for stock trading, MetaStock integrates advanced artificial intelligence, enhancing the precision and effectiveness of decisions.

- Comprehensive Market Insights: Users benefit from comprehensive market insights, enabling them to stay informed and adapt their strategies to changing market conditions.

Pricing

I recommend visiting their official website or contacting customer support directly to obtain the most accurate and up-to-date information on MetaStock’s pricing, including subscription plans, features included, and any potential additional costs. They typically provide detailed and current information about their offerings and pricing structure.

Pros & Cons

Pros:

- Rapid Market Analysis: MetaStock enables users to analyze the stock market in seconds, providing a swift and comprehensive overview of market conditions.

- Advanced Analytical Tools: Traders benefit from advanced analytical tools, facilitating precise technical analysis for making well-informed decisions.

- Efficient Strategy Development: The platform supports efficient strategy development, allowing users to optimize their trading approaches for enhanced effectiveness.

- User-Friendly Interface: With a user-friendly interface, MetaStock ensures accessibility for traders, fostering a seamless and intuitive trading experience.

Cons:

- Learning Curve: Users may encounter a learning curve, particularly when navigating the advanced features and tools available on the MetaStock platform.

- Complexity in Bots for Stock Trading: For those using bots for stock trading, the integration may have a degree of complexity that could pose a challenge for some users.

- Comparison of Top Stock Trading Platforms: Traders may need to compare MetaStock to other top stock trading platforms to determine the best fit for their needs.

9. Algoriz

Algoriz emerges as a notable player in trading platforms, offering a unique blend of sophisticated technology and innovative solutions. Renowned for its cutting-edge approach, Algoriz leverages the power of AI and machine learning to provide users with one of the most advanced and efficient trading bots on the market.

The platform is designed to optimize trading strategies, offering traders a comprehensive toolkit to enhance their decision-making processes and navigate the complexities of the financial markets with precision and effectiveness.

Key Benefits

- Optimization Capabilities: The platform excels in trading approaches, providing users with tools to refine and improve their strategies for better performance.

- Dynamic Trading Bots: Algoriz boasts dynamic and efficient trading bots, offering users a powerful automation tool to execute trades seamlessly based on AI-driven analyses.

- Comprehensive Decision-Making Toolkit: Users benefit from a comprehensive toolkit that aids decision-making, leveraging the platform’s advanced features to make informed and strategic choices.

- Adaptability to Market Conditions: Algoriz is designed to adapt to changing market conditions, ensuring traders can stay responsive and adjust their strategies in real time.

- User-Friendly Interface: The platform features a user-friendly interface, enhancing accessibility for traders of various experience levels and facilitating a smooth user experience.

- Real-time Analytics: Algoriz provides real-time analytics, allowing users to stay updated on market movements and make timely decisions based on the latest data.

Pricing

To obtain the most accurate and up-to-date information regarding Algoriz’s pricing, including subscription plans, features included, and any potential additional costs, I recommend visiting their official website or contacting their customer support directly.

Pros & Cons

Pros:

- Advanced Trading Software: Algoriz stands out with its advanced trading software, leveraging cutting-edge technology to enhance and improve trading strategies.

- Efficient AI Capabilities: The platform incorporates efficient AI capabilities, providing users with sophisticated tools to make well-informed decisions and improve their trades.

- Optimization Features: Algoriz excels in optimization features, allowing users to refine their trading strategies and enhance overall performance.

- User-Friendly Interface: With a user-friendly interface, Algoriz ensures accessibility for traders, making it easier to navigate and utilize the platform effectively.

Cons:

- Learning Curve: Some users may encounter a learning curve when adapting to the advanced features of Algoriz, particularly if they are new to AI stock trading software.

- Pricing Considerations: Users may need to consider the pricing structure carefully, depending on their budget constraints and preferences, when choosing Algoriz to improve their trade strategies.

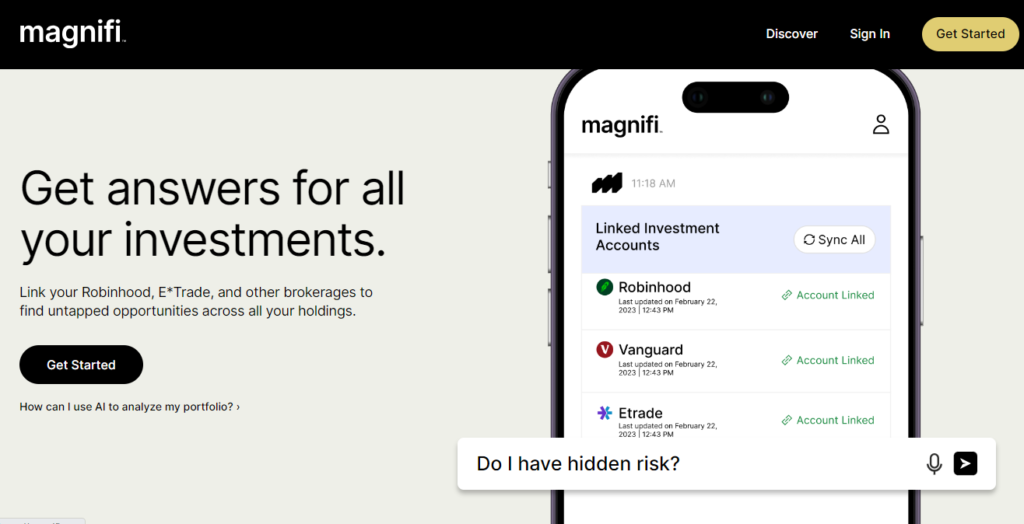

10. Magnifi

Magnifi emerged as a leading platform, revolutionizing the landscape of stock trading with its advanced AI application. Designed to empower traders with sophisticated tools, Magnifi excels in AI trading management, providing users with enhanced capabilities to navigate the complexities of the stock market.

Key Benefits

- AI Software for Stock Trading: Magnifi distinguishes itself with a cutting-edge AI bot tailored for stock trading, ensuring users can access advanced analytics and insights for informed decision-making.

- Trading Management Excellence: The platform excels in AI trading management, offering users efficient tools to streamline their trading strategies and optimize their overall trading performance.

- Paper Trading Integration: Magnifi seamlessly integrates paper trading, allowing users to practice and refine their strategies in a risk-free environment before engaging in live trading, enhancing the learning and decision-making process.

Magnifi, with its AI prowess and emphasis on effective trading management, emerges as a valuable resource for traders seeking a comprehensive and technologically advanced platform.

Pricing

To obtain the most accurate and up-to-date information regarding Magnifi’s pricing, including subscription plans, features included, and any potential additional costs, I recommend visiting their official website or contacting their customer support directly.

Pros & Cons

Pros:

- Advanced AI Software: Magnifi stands out for its advanced AI bot designed for stock trading, providing users with sophisticated analytics and insights.

- Efficient Trading Management: The platform excels in AI trading management, offering efficient tools for users to streamline their trading strategies and enhance overall performance.

- Paper Trading Integration: Magnifi seamlessly integrates paper trading, allowing users to practice and refine their strategies in a risk-free environment before engaging in live trading.

- Informed Decision-Making: Users benefit from informed decision-making capabilities, leveraging the platform’s AI-driven insights for more strategic and well-informed trading choices.

Cons:

- Learning Curve: Some users may experience a learning curve, particularly when navigating the advanced features and tools of Magnifi’s AI app.

- Potential Cost Considerations: Depending on individual preferences and budget constraints, users may find it necessary to carefully evaluate the cost implications associated with Magnifi’s offerings.

Conclusion

In conclusion, diving into the world of AI investing bot is like entering a futuristic marketplace where algorithms do the tango with market trends. It’s been quite the journey exploring the best companions in the form of these sophisticated bots, each vying for the title of your trading confidant. As we bid farewell to this algorithmic adventure, remember that even the most advanced bots could use a bit of human touch – after all, they might be masters of data, but they haven’t quite cracked the code on dad jokes yet.

So, whether you’re team TrendSpider, Trade Ideas, or any other AI marvel, may your trades be profitable, your algorithms be evergreen, and your investment portfolio be the envy of Wall Street. Happy trading, and here’s to a future where even our bots can appreciate a good punchline!